Adding IHG to the Watchlist: Compounder on Sale?

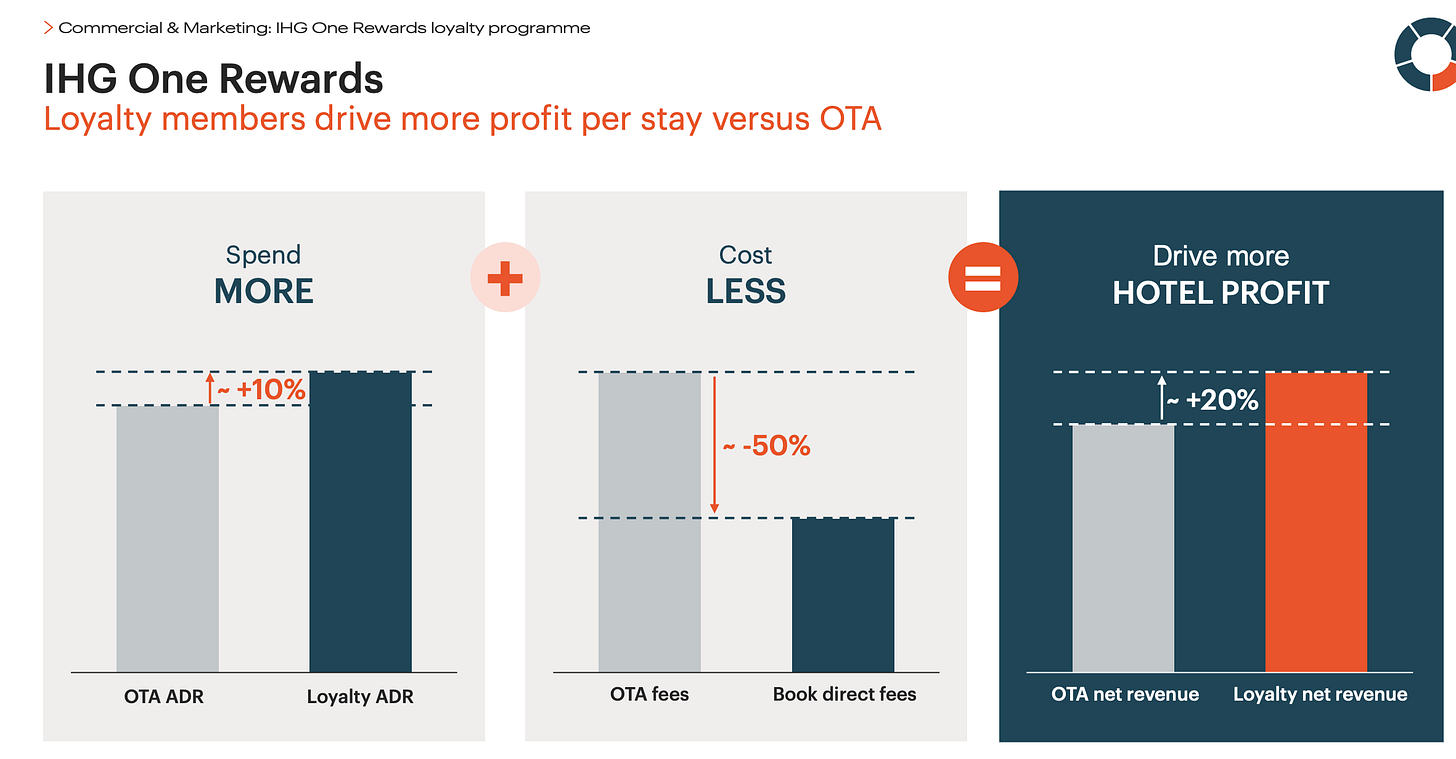

After nearly two decades of delivering 11.5% annual EPS growth, this proven compounder is on sale. Here's my research framework for figuring out why, and what comes next.

I am always on the lookout for attractive entry points into proven compounders, and a potential opportunity may be emerging in IHG. Shares are down around 10% year-to-date as the market grows more concerned with RevPAR trends, particularly in the US.

The pessimism is interesting because IHG is produced the definition of strong through-the-cycle returns. For nearly two decades, its scalable, high-margin, asset-light franchise model has produced an incredible 11.5% in annual EPS growth.

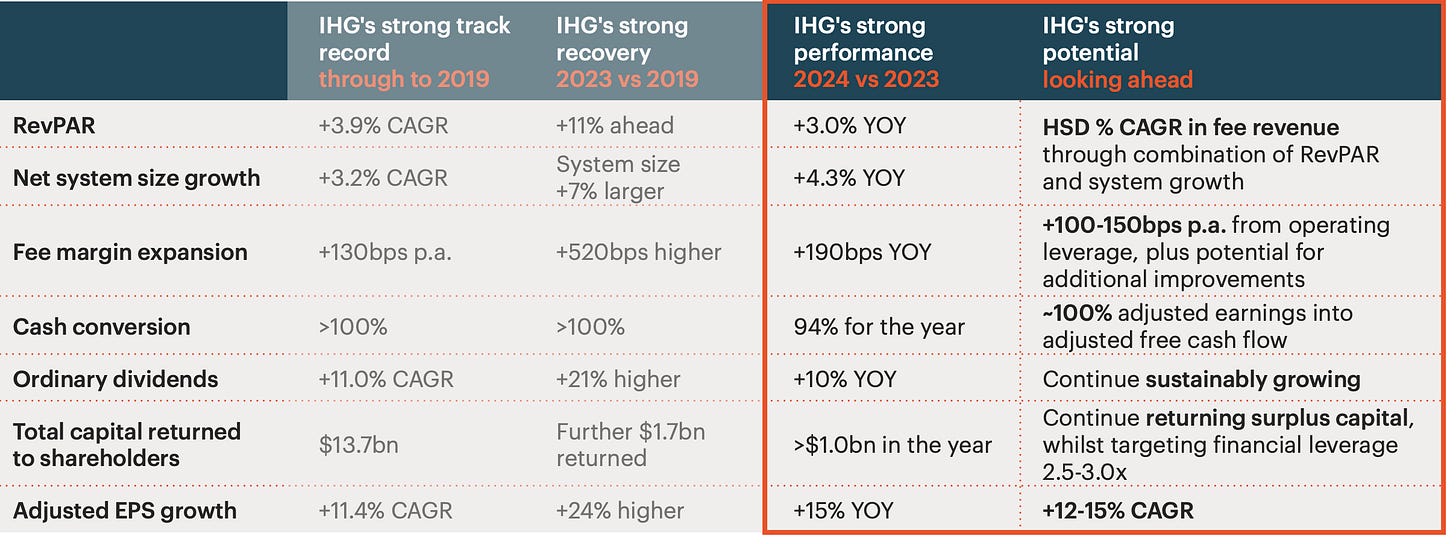

IHG Historical Financial Performance

Looking ahead, the fundamentals appear to be strengthening. A robust hotel pipeline should support future growth, while the company’s revamped loyalty program is improving the underlying economics of the business. There seems to be a real disconnect between a potential inflection in the company's growth seems while the company’s valuation trades a historically wide discount to other hotel peers.

This makes IHG a perfect candidate for my watchlist and asking the question : Are concerns around RevPAR trends justified enough to overlooked this proven compounder?

Proven Compounder

At its heart, IHG operates a classic franchise business model. Rather than owning hotels, IHG sells the rights to its brand names (like Holiday Inn) and provides management services in return for fees based on room revenue.

The economics of this model are extremely powerful, providing high margins (c. 45%) and a superb ROIC (c. 50%). More importantly, the model creates self-perpetuating returns on scale: the size of IHG’s system allows for greater investment in its brands and marketing, which drives higher demand from guests. This, in turn, attracts more hotel owners to the system, creating even more scale.

This flywheel has produced a highly effective growth algorithm for the company,

IHG Growth Algorithm, H1 2025

As we can see IHG’s business model is driven by three key levers:

System Growth: RevPAR and new hotel supply combine to generate mid-single-digit growth.

Margin Expansion: Leverage on fixed costs drives around 160 bps of margin expansion annually.

Capital Returns: High capital efficiency has allowed for $13.7bn to be returned to shareholders over 20 years.

Crucially, with roughly half of IHG's growth linked to system expansion, executing on its development pipeline is key. The current size of that pipeline points to a potential acceleration from here

Does the pipeline provide a growth infection?

One of the most compelling signals that IHG's compounding can continue is the health of its development pipeline. The current pipeline of committed new hotels stands at 33% of IHG's entire system size—the highest level since 2018. This provides a powerful, locked-in growth engine; simply by executing on this existing pipeline, IHG could increase its fee-generating base by a third.

IHG System Pipeline, FY2024

The foundation of this pipeline also looks solid across several key metrics:

Broad-Based Growth: All existing brands have a pipeline equivalent to over 20% of their current size, and 10 new brands have been successfully launched.

Improving Mix: IHG is strategically increasing the proportion of higher-fee-per-key luxury and lifestyle developments.

Sustainable Momentum: New hotel signings are still growing faster than net system growth, meaning the pipeline itself continues to expand.

In essence, while IHG currently operates only 4% of the world's hotels, it accounts for a 10% of the total global supply pipeline. This positions the company for robust and visible growth for years to come.

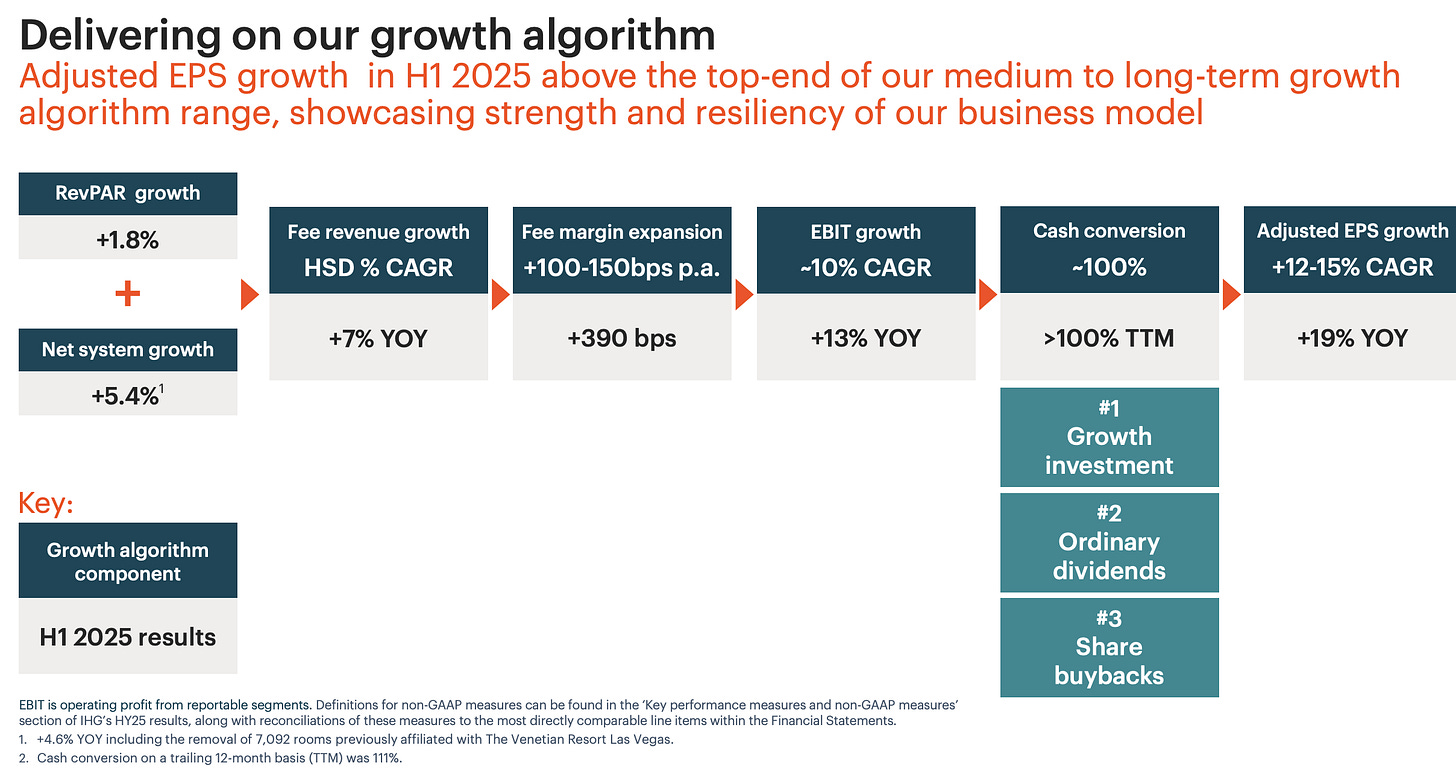

A Widening Loyalty Based Moat?

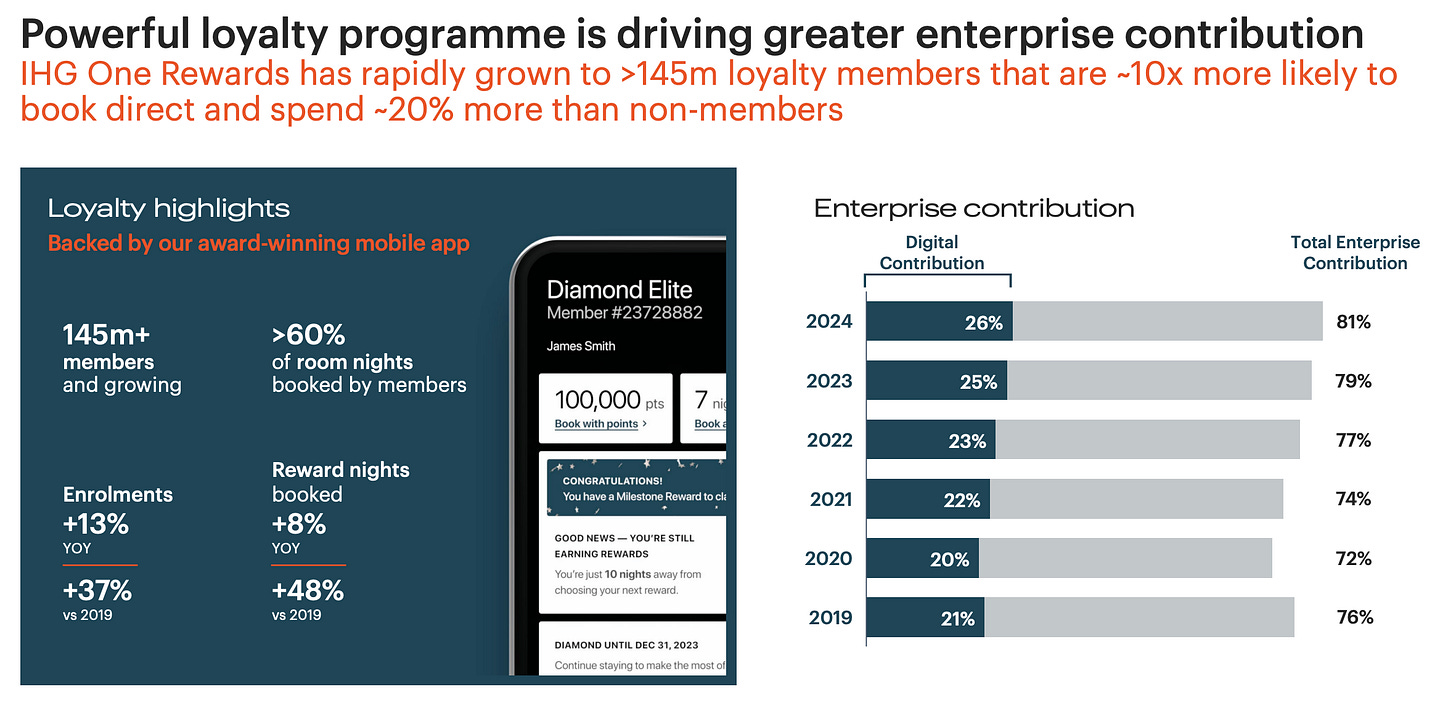

Alongside a potential growth inflection, IHG's revamped loyalty program, IHG One Rewards, is a powerful engine that both improves business economics and widens the company's competitive moat.

IHG loyalty Program Metric FY2024

The program's scale is immense, now boasting 145 million members globally and continuing to grow at a double-digit annual rate. This scale has a direct financial impact, as loyalty members now book over 60% of all room nights across the IHG system. These customers are more profitable as they tend to spend more per stay and book directly, avoiding costly commissions to online travel agents. The large member base creates opportunities for high-margin, incremental fees, such as co-branded credit card agreements, which IHG aims to triple by 2028.

IHG Loyalty Program Margin Impact

Beyond these direct economics, the loyalty program is a tangible manifestation of IHG’s scale advantage. An individual hotel owner could never develop a program of this size. Instead, they benefit from IHG's ability to deliver a consistent and meaningful stream of high-value guests. This increases the attractiveness of joining and remaining within IHG's network, reinforcing the flywheel effect that drives the entire business. Crucially, with IHG's loyalty program contribution still trailing that of its peers, suggesting this powerful tailwind has significant room to run.

Relative Valuation opportunity

The final piece of the puzzle is the valuation. On the surface, IHG appears cheap, trading at a historically wide discount to its primary peers, Marriott and Hilton.

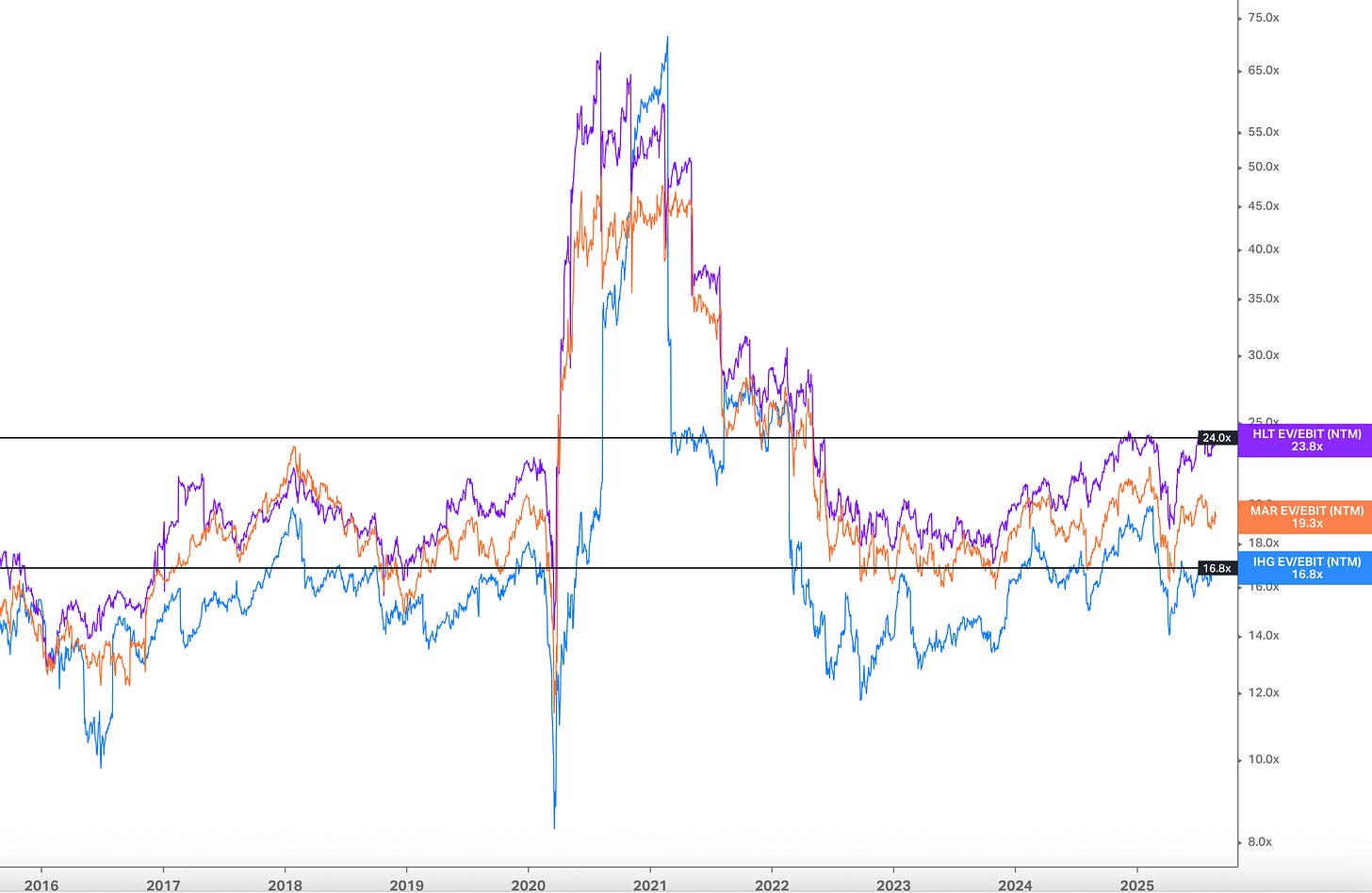

Looking at the numbers, IHG trades on a forward EV/EBIT multiple of 16.8x, compared to 19.4x for Marriott and 24x for Hilton. A similar story emerges with P/E multiples, where IHG's 22.8x is notably lower than its peers.

IHG vs HLT/MAR EV/EBIT, 2015-2025

The central question for our research is to determine why this discount is so wide. IHG’s greater exposure to China and a structurally lower margin profile likely warrant some discount. However, whether the current gap is fully justified is open to debate. If it's an overreaction, then given the strong growth drivers we've already identified, today's price could represent a compelling entry point.

The Due Diligence Agenda

The evidence suggests there might be a compelling idea here. However, before this can move beyond the watchlist, critical work must be done. The market's fear over a slowing economy is the starting point for a deeper research agenda.

Deconstructing the Business Model: The first step is to build a bottom-up understanding of IHG’s returns and resilience. This means analyzing hotel-level economics, understanding management's investment decision process, and stress-testing the model by digging into historical peak-to-trough changes in both RevPAR and operating margins during past downturns.

Benchmarking the Competitive Landscape: IHG’s performance doesn’t exist in a vacuum. The next step is to compare its business model and strategy directly against its peers. How does growth, margin, returns compare across these peers? Is Hilton pursuing a different strategy, and if so, why? A deep understanding of these strategic differences provides a better sense of how each "boat in the industry is being sailed" and is often the most useful part of any research process.

Validating the Quality of Growth: The pipeline numbers are impressive, but they need to be verified. This involves researching how the broader market is absorbing new hotel supply, particularly in key markets like China. We also need to determine if recent hotel closures are actually improving the underlying quality and performance of the system by removing underperforming assets.

Scenarios, Scenarios, Scenarios: The final step is to synthesize this research into a financial framework. IHG’s clear growth algorithm lends itself to building bull, base, and bear case scenarios based on different RevPAR trends, system openings, and margins. This model can then be used to test the impact of specific drivers—like credit card fees or the shift to luxury—to better understand the range of potential outcomes for IHG’s intrinsic value.

A strong Candidate for the Watchlist

In summary, IHG presents the profile of a high-quality business facing short-term market headwinds—often the setup for a compelling investment idea. More importantly, the company aligns well with the core tenets of my investment process.

What makes IHG so interesting is how strong each of those tenets appears. First, its product is a powerful, system-level ecosystem of brands with global recognition that delivers a consistent stream of demand to hotel owners—a competitive advantage an independent operator could never build. Second, its economic model is the definition of a compounder: an asset-light business with high returns on capital and a self-reinforcing flywheel where scale begets more scale. Finally, the strategy is clearly focused on the twin pillars of pipeline growth and leveraging the company’s loyalty program.

For these reasons, IHG earns its spot on the watchlist. The bull case is clear, but the questions remain to be answered. Time to execute on the research agenda.