Kainos plc: 3 ways it is undervalued

How Weaker Short-Term Results Mask Significant Underlying Value and Upside in this Leading UK IT Services & Software Specialist

In the relentless pursuit of quarterly beats, even fundamentally sound companies delivering consistent value can fade from investor focus, particularly when near-term growth trajectories encounter turbulence. Kainos, the UK-based IT services provider, increasingly feels like it is in such a moment. On paper, this is a business with many of the hallmarks of a high-quality, strategically astute operation: a five-year revenue CAGR of 15.5%, operating margins consistently flirting with the 20% mark, and returns on invested capital that comfortably exceed 30%. These are not the metrics of a struggling enterprise.

Yet, the narrative in the market has soured. A slowdown in growth over recent periods – due to the disruption in UK government decision-making cycles – has seemingly led to a crisis of confidence among investors. The result? A share price that has eroded by 38% in the last year alone. This precipitous drop is less a fundamental reassessment of Kainos’s long-term prospects and more a stark illustration of how weak sentiment, fixated on transient headwinds, has left a quality enterprise fundamentally undervalued, thereby creating a clear opportunity.

The current discourse around Kainos appears to be dominated by an excessive focus on immediate growth momentum, or the temporary lack thereof. This preoccupation, I contend, is obscuring the fundamental, enduring value embedded within Kainos’s multifaceted business. The debate shouldn't solely be about when growth will re-accelerate, but rather why the underlying assets and strategic positioning of Kainos are being undervalued right now.

This analysis will not attempt to predict the precise quarter in which growth will return to its historical trendlines, or even engage in a growth debate at all. Instead, it will demonstrate, through several distinct valuation framework, that Kainos is currently mispriced. The valuation arguments are threefold:

Sum of the Parts (32% Upside): The market is failing to appropriately value Kainos’s burgeoning, high-margin software products division – a classic scenario where a valuable SaaS asset is overshadowed by a larger, more traditional services business. Furthermore, relative to its peers, even considering recent transactions, Kainos’ Services appears undervalued, suggesting a broader mispricing rather than investors merely overlooking software revenues.

Earnings Powers: There seems to be a fundamental misunderstanding, or at least a significant discounting, of the inherent, sustainable earnings power of Kainos’s core operations. This has led investors to implicitly price in extraordinarily low, almost pessimistic, expectations for future growth.

Discounted Cash flow (54% Upside): Given Kainos ongoing significant Free cash generation even basic growth assumptions would yield significant upside to the current share price.

The conclusion, even when applying conservative assumptions, points towards significant potential upside from the current share price. For investors capable of looking beyond the immediate turbulence and appreciating the strategic underpinnings of a resilient business, Kainos presents a compelling mispricing opportunity. This is about recognizing the enduring strategic value when others are fixated on the cyclical squalls.

An Introduction to Kainos: The Tripartite Structure of Digital Enablement

Headquartered in Northern Ireland, Kainos Group operates as an IT services company, which operates across the government, commercial, and healthcare sectors, assisting organizations in navigating complex digital transformations.

Kainos counts a significant of major Government and multi-national companies as customers

Kainos prosecutes this mission through three distinct, but overlapping, divisions: Digital Services, Workday Services and Workday Products:

Digital Services: The Enduring Foundation in Public Sector Transformation

The Digital Services arm of Kainos has long served as the company’s primary revenue and operational engine. Its track record is substantial, marked by the delivery of over 100 significant IT projects for various UK government departments. While there's a component of commercial sector work, the UK public sector is the dominant force here, accounting for a striking 89% of this division's revenue. This high concentration speaks volumes about the depth of Kainos’s relationships, its accumulated domain expertise, and its trusted status within governmental procurement circles.

Kainos's engagements in this sphere are rarely trivial. They are often large-scale, high-profile, and mission-critical undertakings. Consider the development of the NHS app for NHS Digital, a platform that has become a central point of interaction for millions of citizens with the UK's healthcare system. Or look at the creation of the online passport application service for the Home Office, a project that has fundamentally modernized a core civic function. These are complex, secure, and scalable solutions that underscore Kainos's technical and project management capabilities – qualities that are paramount in public sector contracts.

While government projects form the core, the division also maintains a portfolio of over 50 commercial customers, with a notable concentration in the financial services industry.

The tendering environment for public sector IT projects is, admittedly, not for the faint of heart. It is inherently competitive, often characterized by complex procurement processes and a degree of political sensitivity. Indeed, the recent shifts in the UK government did introduce some friction, impacting project timelines and budgetary approvals in the past year. However, despite these inherent challenges, the UK public sector remains a remarkably robust and surprisingly dynamic marketplace for digital services. The underlying driver is a powerful and enduring one: the relentless pursuit of cost savings, enhanced efficiency, and improved citizen services through digitization. This makes digital transformation a persistent, high-priority spending area for the UK government, irrespective of the political climate.

The data supports this assertion. UK government spending on digital transformation has expanded at a compelling 21% CAGR over the past decade, reaching an annual outlay of £3.3 billion. Within this substantial and growing market, Kainos is estimated to hold a respectable 6% share, a position fortified by established relationships spanning over 16 different government departments. This is not a fleeting presence but a well-entrenched incumbency. This position is further solidified by its competitive advantage derived from significant scale advantages, being one of the largest and most experienced digital transformation partners to the UK government, allowing it to bid for and deliver on the most complex and sizeable projects.

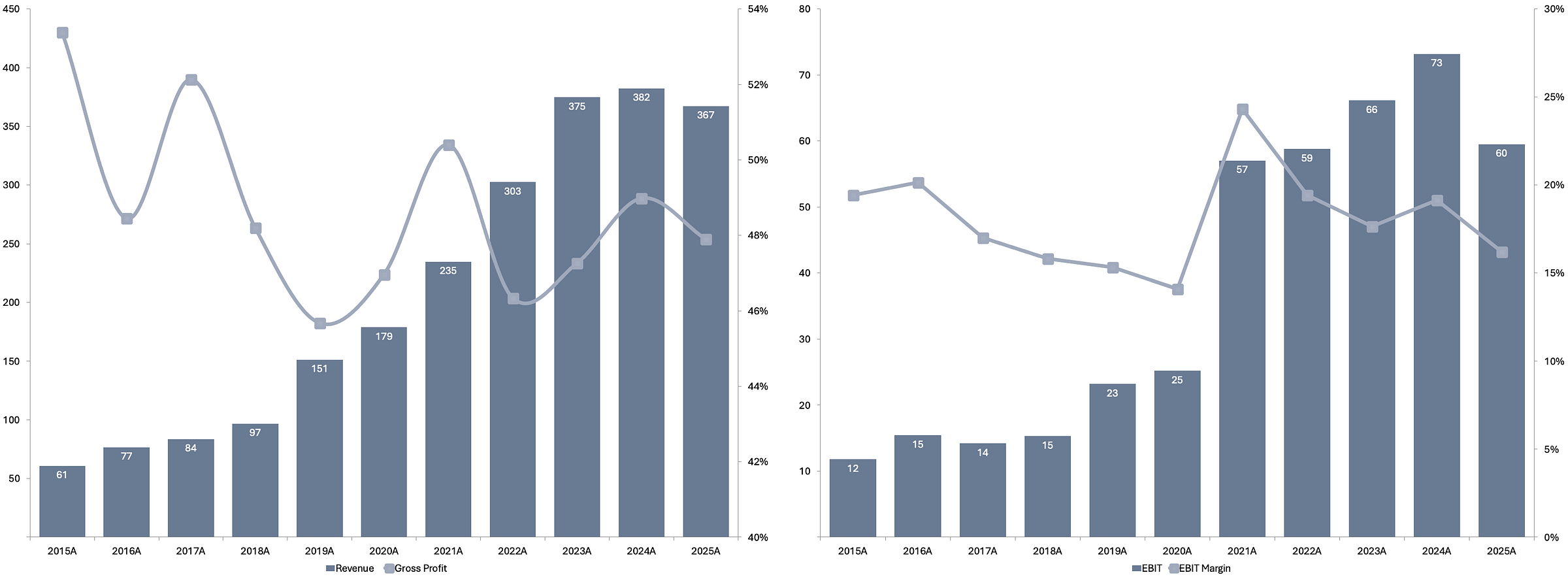

Historically, the Digital Services division has delivered a 10% revenue CAGR over the last five years. This steady cadence of growth experienced a significant, albeit temporary, uplift during the COVID-19 pandemic, with growth rates surging to as high as 45%.

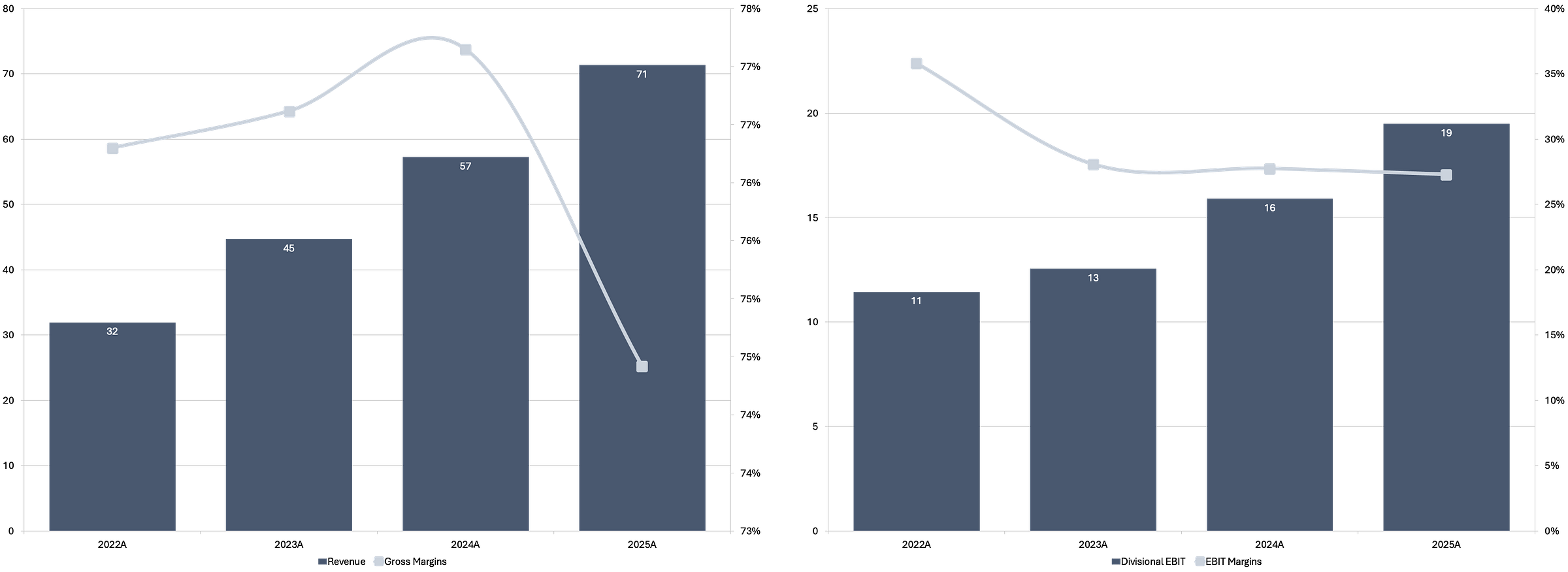

Kainos Digital Services, Financials 2017-2025

More recently, however, the growth trajectory has moderated. This deceleration is largely attributed to disruptions in client budgeting cycles – a common phenomenon in the lead-up to major political events like the 2024 UK general election – and a general tightening of discretionary spending. The division has, in fact, registered revenue declines of -5% and -7% in the last two fiscal years. This top-line pressure has, predictably, flowed through to margins, primarily due to a decline in staff utilisation rates. When anticipated project volumes soften, billable consultants can become underutilized, directly impacting profitability in a services-heavy business. Consequently, the EBIT margin for Digital Services currently stands at 25.5%, a noticeable dip from its 2021 peak of 34%. While this margin compression warrants attention, it appears to be a direct consequence of the revenue slowdown and should, theoretically, see improvement as project flow and client budgeting normalize, to which, the long-term demand drivers remain intact.

Workday Services: Navigating the Ecosystem Dynamics of a Cloud Giant

Shifting focus to Kainos's Workday Services division, we encounter a business unit deeply enmeshed in the ecosystem of a major enterprise SaaS platform. Kainos provides an extensive suite of services – from initial strategic consulting and project management to complex systems integration and crucial post-deployment support – for organizations adopting Workday’s Human Capital Management (HCM) and Financial Management software. As corporations increasinglymigrate these core functions to the cloud, the demand for expert implementation and optimization services, like those Kainos provides, becomes critical.

Kainos's relationship with Workday is both long-standing and strategically significant. The initial engagement dates back to 2009, culminating in a formal partnership in 2011. Kainos holds the notable distinction of being the only specialist Workday partner headquartered in the UK, but its operational ambitions and reach are decidedly global. A substantial 75% of its Workday projects are undertaken for clients based in Central Europe and North America, highlighting its ability to compete and deliver on an international stage. This geographic diversification is a key strength, offering access to larger addressable markets and mitigating reliance on demand for Workday for any single territory .

The company's client roster in this segment is impressive, featuring over 300 international Workday customers. This list includes well-known enterprises such as Kion Group (Germany), Novozymes (Denmark), Kone (Finland), ASOS plc (UK), Takeaway.com (Netherlands), and Match.com (USA). Such a portfolio underscores Kainos's capability to manage and deliver complex Workday deployments for large, often multinational, corporations with sophisticated requirements.

Historically, the Workday Services division has been a powerful engine of growth for Kainos. In the five fiscal years preceding FY25, this segment achieved a robust 27% annual growth rate. This rapid expansion was propelled by the strong secular growth of Workday itself, as it captured increasing share in the HCM and financials market, and by Kainos's adeptness at securing a significant portion of the European market, a substantial high growth area for Workday.

Kainos Workday Services, Financials 2017-2025

However, the dynamics within the Workday partner ecosystem have evolved. Changes implemented within Workday’s partnership program, under the stewardship of its new CEO, appear to have altered the competitive landscape for service providers like Kainos. The ecosystem has become more crowded, leading to intensified competition for Workday implementation and related services. This heightened competitive pressure, inevitably, has exerted a downward force on pricing for some services. Consequently, this division has experienced a revenue decline in FY25. This is a crucial headwind to acknowledge, as it appears to stem from a structural shift in the partner ecosystem rather than being a purely cyclical phenomenon. The strategic imperative for Kainos here is to adapt its service offerings, differentiate its value proposition, and perhaps deepen its specialisation to thrive in this more contested environment.

Workday Products: The Ascendant SaaS Engine Within

Leveraging its deep expertise from the Workday Services practice, Kainos has developed a portfolio of four proprietary software tools, with a fifth product slated for launch towards the end of the current year. These are not mere peripheral utilities; they are designed to deliver significant, tangible value by supplementing Workday’s core platform with critical additional capabilities.

Key functionalities offered by these products include sophisticated tools for testing Workday customers’ unique configurations – a non-trivial and often resource-intensive task, given the inherent customizability of Workday deployments. They also provide robust compliance-monitoring solutions, enabling customers to maintain stringent operational controls and meet regulatory requirements within their Workday environments. These are addressing real pain points for Workday users.

Critically, these tools are delivered as cloud-based Software-as-a-Service (SaaS) solutions. Customers subscribe to these products, generating valuable, predictable, and recurring revenue streams for Kainos. This model stands in stark contrast to the project-based, often less predictable, revenue characteristic of its services divisions. The market adoption of these products has been impressive, with over 450 customers globally now utilizing at least one of Kainos's Workday Product offerings. This client roster is not confined to a single geography or industry; it includes globally recognized brands such as AT&T, Booking.com, Whole Foods, and Netflix. This diverse adoption underscores the broad applicability and compelling value proposition of these tools.

From a financial perspective, the Workday Products division has been an unqualified success story for Kainos. Beginning with its flagship WorkSmart automated testing product, Kainos has meticulously cultivated this SaaS revenue stream, growing it from a relatively modest £4 million in 2017 to a substantial £71.3 million in the most recent fiscal year (FY25). This represents a stellar growth trajectory, demonstrating strong product-market fit and effective go-to-market execution.

The ambition for this division remains resolutely high. Kainos has publicly stated its target of achieving £200 million in Annual Recurring Revenue (ARR) for this segment by the end of the decade. Reaching this milestone would not only represent a significant financial achievement but would also fundamentally transform Kainos’s revenue composition, increasing the proportion of high-quality, recurring software revenues and likely commanding a significantly higher valuation multiple for the group as a whole.

What makes this segment particularly compelling is its profitability, especially for a software business still firmly in a high-growth phase. The Workday Products division concluded FY25 with impressive EBIT margins of 25%. This level of profitability is healthy by any software industry standard, but it is particularly noteworthy given that it was achieved alongside substantial ongoing investment. These investments include the "Build on Workday" sales program – an initiative designed to further expand the product suite's market reach and deepen its integration within the Workday ecosystem – and continued, significant spending on research and development for new product innovation.

Kainos Workday Products, Financials 2017-2025

This ability to simultaneously deliver strong top-line growth and robust profitability underscores the inherent quality of these software assets. It points to efficient product development, effective pricing strategies, and a scalable operational model. The Workday Products division is, in essence, a high-performing SaaS business embedded within a larger services organization, and it is this component that the market appears to be most significantly undervaluing or misunderstanding. The strategic foresight to build this product capability on the back of deep services expertise is a testament to Kainos's management.

Financials: A Portrait of Resilience and Emerging SaaS Strength

When we aggregate the performance of Kainos’s three distinct divisions, the company’s overall financial profile, while recently impacted by macroeconomic and sector-specific headwinds, retains many characteristics of a robust and well-managed enterprise. As of the latest reporting, Digital Services contribute 54% of total group sales, with Workday Services accounting for 27%. Most significantly from a strategic and valuation perspective, the software-based revenue from Workday Products now constitutes nearly 20% of total sales. This steadily increasing proportion of high-quality, recurring software revenue is a pivotal element in the evolving Kainos investment narrative.

Although the overall growth rate has moderated in the very recent past, it is essential to view this within the context of a strong longer-term track record. Kainos has still maintained a commendable 15.5% sales CAGR over the last five years. This sustained growth, even with recent dips, speaks to the underlying strength of its market positioning and the enduring demand for its services and products.

Furthermore, Kainos’s margin profile is genuinely sector-leading. Gross Margins stood at a healthy 47% in FY25, with group EBIT margins at 16% for the same period. These are figures that many competitors would find enviable, reflecting Kainos’s operational efficiency, its ability to command reasonable pricing for its value-added services, and the positive mix effect from the higher-margin Workday Products.

Kainos, Financials 2017-2025

This combination of historical growth and sustained profitability, coupled with what is typically strong and consistent cash generation, has enabled Kainos to produce significant free cash flow (FCF). Over the last five years, the company has generated a notable £300 million in FCF, with £55 million produced in FY25 alone. This robust financial engine is clearly reflected in its pristine balance sheet. Kainos currently boasts over £130 million in net cash, a sum equivalent to approximately two times its EBITDA. Such a strong net cash position affords considerable operational flexibility, the capacity to strategically invest in growth initiatives (particularly in the further development and market expansion of Workday Products), and the ability to consistently return capital to its shareholders.

And Kainos is indeed actively returning capital. This is being achieved through a dual approach: a progressive dividend policy and a recently launched program of share buybacks, which will amount to c£38 million over FY26. Combined, these initiatives represent an attractive 8% prospective total shareholder return based on the current valuation – a compelling yield, especially from a company that still possesses significant avenues for future growth.

However, Kainos’s latest financial results (FY25) undeniably underscored the challenging growth environment the company is currently navigating. Revenue in the core Digital Services segment declined by 7% year-over-year to £197.2 million. Within this, the crucial public sector revenue stream saw a steeper contraction of 9% year-over-year, falling to £125.5 million. This was directly attributable to the previously discussed weakness and delays in UK public sector procurement cycles, likely exacerbated by political uncertainties.

The Workday Services division also continued to experience the impact of softer market conditions and the heightened competitive pressures within the Workday partner ecosystem. Segment sales in this division declined by 12% (or 8% on a like-for-like basis, adjusting for any minor acquisitions or divestitures) to £98.7 million.

The conspicuous bright spot in the results, unsurprisingly, was the Workday Products division. This segment continued its impressive growth trajectory, with strong performance across all its product offerings leading to a 24% year-over-year revenue increase, reaching £71.3 million. This resilient performance, in stark contrast to the services divisions, powerfully underscores the strategic importance of this SaaS business and its relative insulation from some of the headwinds buffeting project-based services.

The lower revenue contributions from the two larger services businesses inevitably led to a decline in overall group margins. This was primarily driven by the previously highlighted falls in staff utilisation rates within these services segments – a direct consequence of softer demand. Group EBIT for FY25 came in at £59.5 million, translating to an EBIT margin of 16.5%. While this represents a decline, the company noted that the impact was somewhat mitigated by disciplined cost management initiatives across the organization and, crucially, by the positive influence of the growing, higher-margin Workday Products business on the overall revenue mix. This again serves to highlight the strategic and financial value of Kainos’s burgeoning SaaS portfolio in providing a degree of earnings resilience and margin support during periods of stress in its traditional markets.

Sum-of-the-Parts (SOTP) Valuation: Illuminating the Embedded Software Value

The presence of a rapidly expanding, highly profitable software business – Workday Products – nestled within the broader Kainos structure naturally leads us to our first, and perhaps most illuminating, valuation methodology: the Sum-of-the-Parts (SOTP) analysis. This approach is particularly potent when analyzing companies like Kainos, which comprises divisions with markedly different financial dynamics and market perceptions.

Specifically, an SOTP framework allows us to assign a distinct valuation to the Workday Products division, treating it more like comparable publicly traded or recently acquired Software-as-a-Service (SaaS) businesses. This is a critical step because the broader market often struggles to accurately price such a high-growth, high-margin software entity when it's embedded within a larger, more traditional IT services conglomerate. The services business multiple tends to dominate, obscuring the premium value of the SaaS assets. By isolating Workday Products, we can gain a much clearer and more realistic indication of the substantial value these recurring software revenues contribute to the overall Kainos enterprise.

Fortunately, a spate of recent takeover activity within the UK technology sector has furnished us with several robust and highly relevant comparable transaction multiples that can be directly applied in this SOTP valuation. This isn't a purely theoretical exercise; these are real-world valued paid by acquirers, offering a real world valuation mark. The recent break-up of FD Technologies, for instance, provides an especially pertinent precedent. This situation yielded distinct acquisition multiples for both an IT service consultancy (First Derivatives, or FD) and a software platform (KX). First Derivatives was acquired by the US-based firm EPAM Systems in late 2024, while KX is currently in the process of being acquired by the private equity firm TA Associates. The divestiture of these two distinct business types from a single parent entity offers a direct and highly analogous case study for analyzing the potential break-up or intrinsic component value of an IT services business, like Kainos, that also houses a valuable software division.

Further bolstering our set of comparables, two pure-play IT services businesses, Kin + Carta and Keywords Studios, were also acquired in 2023. These transactions provide additional, useful valuation benchmarks specifically for Kainos's two services-oriented divisions (Digital Services and Workday Services).

The table above highlights the multiples paid by the acquirers in each of these transactions. For KX, the software platform spun out of FD Technologies, Annual Recurring Revenue (ARR) is used as most appropriate valuation metric. This choice was primarily to account for KX's loss-making status at the time of its transaction. FD Technologies’ own trading update in March provides an up-to-date ARR figure for Kainos's Workday Products over a broadly comparable period, enabling a reasonable like-for-like comparison. For First Derivatives, Kin + Carta, and Keywords Studios – all primarily services businesses – the transaction Enterprise Value to EBIT (EV/EBIT) multiples were utilized. This metric is generally more suitable for services businesses as it appropriately accounts for higher levels of depreciation and amortization found in these of companies versus Kainos.

UK IT Services Acquisition Multiples 2023-2024

By systematically applying these transaction-derived multiples to Kainos's respective divisions, the SOTP methodology yields a clear and empirically grounded valuation marker for Kainos. This valuation is not based on abstract theory but on the tangible prices paid for highly relevant peer companies in the very recent past. The implications of this analysis are compelling: not only do these multiples suggest considerable potential upside to Kainos's current share price, but in my view, they also compellingly demonstrate that Kainos is demonstrably more valuable than the market currently suggests.

Even if one conservatively applies the multiples derived directly from the FD Technologies break-up (using the FD multiple for Kainos's services businesses and the KX multiple for Workday Products), this initial pass already indicates an approximate 17% upside to Kainos's prevailing share price. This, in itself, is a significant finding.

Kainos SOTP Valuation - UK Transaction Multiples

However, a deeper dive, suggests that these FD Technologies-derived multiples likely represent a highly conservative valuation floor for both Kainos's Workday Products and its services businesses. Let's examine why. In a direct comparison with KX (FD Technologies' former software arm), Kainos's Workday Products division is not only growing faster (27% ARR growth for Workday Products versus a reported 13% for KX at the time of its deal) but is also highly profitable (boasting 27% EBIT margins, whereas KX was loss-making). Logic dictates that a faster-growing, profitable SaaS business should command a superior valuation multiple compared to a slower-growing, loss-making counterpart.

Furthermore, when we scrutinize the services side of the comparison, First Derivatives (FD) itself is arguably a subscale general business consultancy operating in more broadly competitive and less specialized markets than Kainos’s focused domains of Workday implementation and UK public sector digital transformation. The tangible financial impact of these differing market positions and operational scales is evident in their respective financial performances: First Derivatives exhibited a slower 5-year growth CAGR and reported margins that were approximately half of those consistently achieved by Kainos's services divisions (prior to the very recent dip). Again, a business demonstrating superior historical growth and significantly stronger margin characteristics should, all else being equal, warrant a superior valuation multiple.

Therefore, the assertion that if any of Kainos's individual divisions were to be acquired, the standalone valuations would likely be considerably higher than those implied by the FD Technologies demerger multiples seems not just plausible, but highly probable. The FD Tech multiples should indeed be viewed as a conservative baseline – a valuation floor rather than a representative ceiling.

A more equitable comparison, and one that likely yields a more accurate intrinsic valuation for Kainos's services businesses, would be to benchmark against Keywords Studios. Both Kainos's services operations and Keywords Studios have demonstrated broadly similar historical growth rates over the last five years. Importantly, even with the recent margin compression, Kainos's services segments still maintain significantly higher profitability than Keywords.

If one were to apply a valuation multiple for Kainos’s services businesses that is either at the mid-point between that of First Derivatives and Keywords, or, more assertively but arguably justifiably, fully in line with the Keywords multiple, while maintaining the same (still arguably conservative) KX-derived valuation for the Workday Products SaaS business, the SOTP valuation would yield a potential upside of 39% and an even more striking 68%, respectively, to Kainos's current share price. This range highlights a substantial level of potential mispricing by the market.

The valuation discrepancy isn't confined to these specific acquisition comparables; it extends to a broader view of the IT services peer group. Trailing EBIT multiples within this wider cohort typically range from 11x to 26x, with an average settling around 17x. Kainos’s current market valuation, however, implicitly assigns its Workday Services and Digital Services divisions an EBIT multiple of approximately 11x – languishing at the very bottom of this peer range. This is a particularly incongruous valuation given Kainos's demonstrably strong historical growth and its sector-leading margin profile. Even if one were to apply a conservative 20% discount to the current sector average multiple for both of Kainos's services businesses (while, importantly, maintaining the distinct ARR-based multiple for the Workday Products division), the implied valuation still generates a 32% upside.

Current Global IT Services EV/EBIT Multiples

To further illustrate the extent of this undervaluation, consider a scenario that, while optimistic, remains within the bounds of rational market behavior – a "blue-sky" yet arguably still conservative view. If Kainos's services businesses were valued in line with the Keywords transaction, and its Workday Products division achieved an 8.1x ARR multiple (a figure not outlandish for a SaaS business with its growth and margin profile), the resultant valuation points towards a potential upside of approximately 80% from the current share price.

While the Workday Products division may present the most obvious and glaring single point of valuation discrepancy within Kainos, I believe these recent transaction multiples for comparable service businesses compellingly demonstrate that investors are also failing to fully recognize and appropriately price the intrinsic value residing in Kainos's established, profitable, and strategically positioned services divisions. The market appears to be applying a broad, undifferentiated discount due to recent cyclical headwinds, thereby overlooking the distinct quality and strategic positioning of each individual component of the Kainos enterprise.

Earnings Power Valuation (EPV): Discerning Sustainable Profitability Through Cyclical Fog

The second valuation framework that offers critical insight into Kainos's current market standing is the Earnings Power Valuation (EPV). This approach attempts to pierce through the shorter-term, often cyclical, headwinds currently buffeting the company and instead focuses on quantifying the underlying, sustainable earnings capability of the business. It is my contention that both Kainos's current market valuation and the prevailing consensus forward estimates regarding its future growth and margins are disproportionately – and perhaps unfairly – anchored to what is likely a temporary downturn, particularly within its core Government digital transformation market. There's a palpable element of recency bias at play, where the market appears to be extrapolating current difficulties too far into the future, without giving due credit to the company's historical resilience and the long-term structural demand for its offerings.

The primary objective of this EPV exercise is twofold: firstly, to demonstrate that Kainos’s true, normalized earnings potential is considerably higher than what the market currently seems to perceive or price in; and secondly, to illustrate that the intrinsic value of this underlying earnings power implies that future growth is being inadequately, if at all, reflected in Kainos’s present market capitalization. In essence, the market might be valuing Kainos as if its current, cyclically depressed earnings are a permanent state of affairs, and as if future growth prospects are negligible or even negative.

An EPV is achieved by making specific, justifiable "growth adjustments" to Kainos's current reported operating costs. The guiding principle here is to identify and notionally add back expenditures that are clearly oriented towards fueling future growth, rather than those required merely to maintain the current level of earnings. These are, by their nature, investments in future revenue streams, not just operational costs attributable to the current period's revenue generation.

For Kainos, this analytical exercise is rendered relatively straightforward, thanks in no small part to the company's own transparent commentary regarding its ongoing restructuring programme and its explicit, strategic investments into the expansion and development of the Workday Products division. The company has publicly detailed a cost restructuring program that is anticipated to yield £19 million in annualized savings. Crucially, management has also indicated plans for a reinvestment of £13 million from these anticipated savings directly into new initiatives specifically designed to stimulate and support future growth. This £13 million is, by definition, growth-oriented spending and can be considered an investment rather than a core operational cost for maintaining the status quo.

Additionally, the rapidly expanding Workday Products segment incurred £5.2 million in additional costs directly related to the "Built on Workday" programme. This initiative is explicitly designed to broaden the product suite, enhance its integration with the Workday platform, and expand its market penetration – clearly an investment in future growth and market share gains for this key SaaS division.

Furthermore, Kainos continues to invest aggressively and strategically in Research and Development (R&D), particularly for the innovation of new Workday products and the enhancement of existing ones. While it's acknowledged that not all R&D expenditure is purely for new growth (a portion is typically allocated to the maintenance and incremental upgrading of existing products), it is reasonable to assume that a significant percentage is indeed dedicated to developing new capabilities and expanding the product portfolio. I assume that 50% of Kainos's current R&D costs are attributable to such growth-focused spending, which amounts to an estimated £6.4 million in growth investment channeled through R&D.

All these identified expenditures – the £13 million strategic reinvestment, the £5.2 million allocated to the "Built on Workday" programme, and the £6.4 million in growth-oriented R&D – are intrinsically associated with investment in future expansion and value creation. These costs can, therefore, be legitimately added back to Kainos's current Adj.EBIT. This adjustment provides a clearer and more insightful understanding of the company's "steady state" profitability – that is, the level of profit Kainos could theoretically generate if it were focused solely on maintaining its current scale of operations without actively investing in further growth initiatives.

The EPV, therefore, offers a snapshot of Kainos's potential earnings capacity if it were to hypothetically cease all growth-related activities and operate as a mature, steady-state business. This adjusted, sustainable earnings figure is then capitalized using the company's current WACC to derive an implied equity value based purely on this normalized earnings power.

The result of this EPV calculation, is striking: the equity value of Kainos, based solely on its current adjusted earnings power (i.e., assuming absolutely no future growth beyond maintaining its current state), is estimated to be £1 billion. This figure compares to Kainos's market capitalization of approximately £900 million at the time the analysis was conducted.

The conclusion one can reasonably draw from this EPV finding is quite profound and speaks directly to the current market sentiment. If the intrinsic value of the business, predicated on an assumption of zero future growth, is already slightly above its prevailing market price, it strongly suggests that investors are, in effect, currently assuming that Kainos will effectively be a declining business over the long term. The market appears to be pricing in absolutely no expectation of future growth into the current valuation, or perhaps even implicitly anticipating further contraction in earnings or scale. This stance seems overly pessimistic, especially when considered against Kainos's robust historical track record, its strong market positions in key niches, and the enduring structural growth drivers inherent in its core markets, particularly digital transformation and enterprise SaaS solutions. The EPV suggests the market is pricing for a storm that has already largely passed or is, at least, being weathered with underlying resilience.

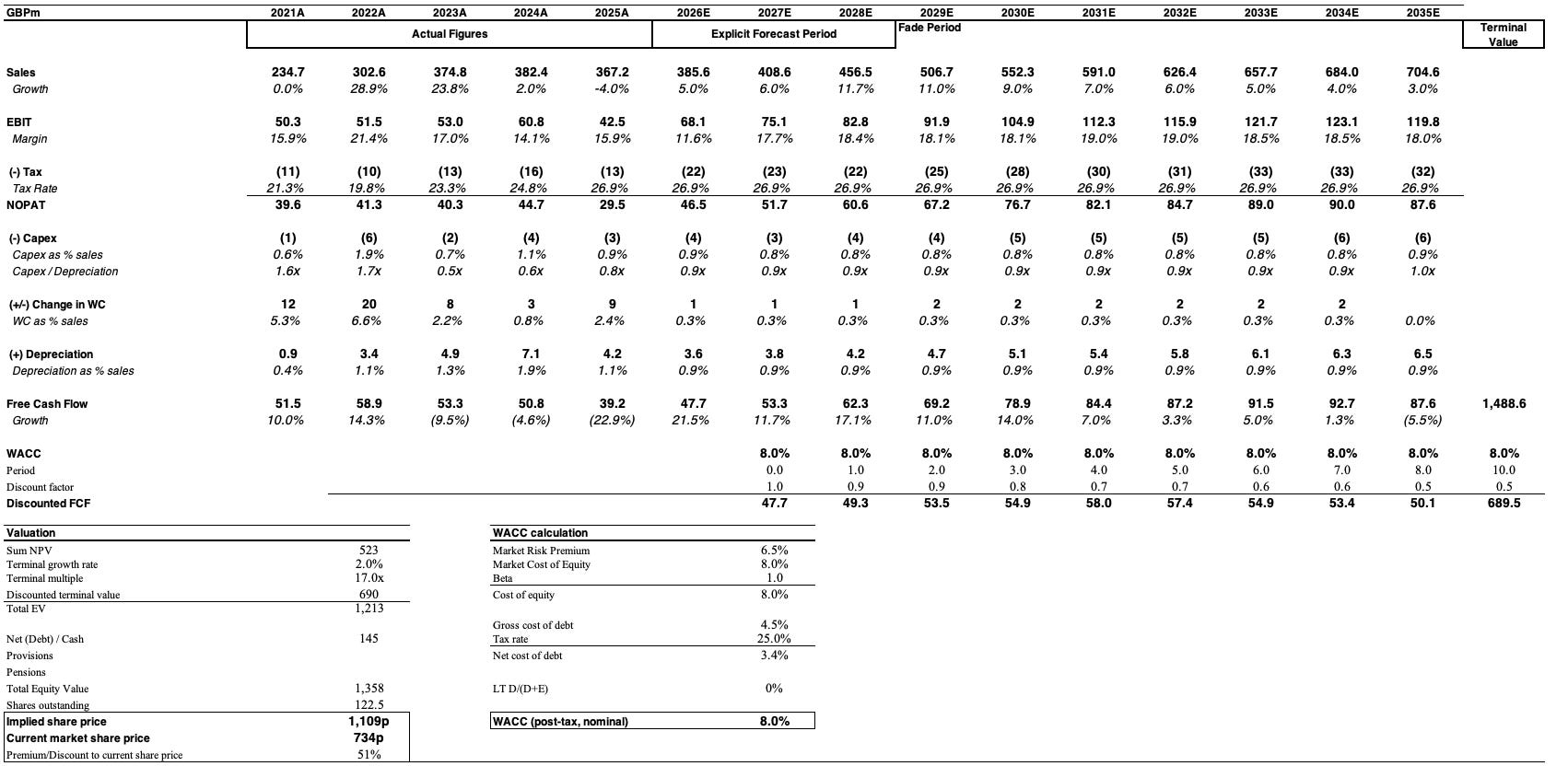

Discounted Cash Flow (DCF) Valuation: The Latent Upside from Even Conservative Growth Assumptions

My third valuation approach, the Discounted Cash Flow (DCF) analysis, directly confronts and challenges the seemingly "no growth" or even "negative growth" expectation that appears to be embedded in Kainos's current market price, an expectation so starkly highlighted by the preceding Earnings Power Valuation. While there is an undeniable and acknowledged lack of near-term growth momentum at present – a factor weighing heavily on investor sentiment – it is critically important to differentiate between temporary, cyclical slowdowns and a fundamental erosion of long-term structural growth opportunities. Each of Kainos’s core operational segments, despite the current array of challenges, continues to offer such structural, long-term growth avenues.

Let us first consider the Digital Services division. UK government spending on digital transformation is, fundamentally, unlikely to decline in any meaningful or sustained way over the medium to long term. The inexorable drive for enhanced efficiency in public services, better and more accessible citizen interactions, and the continuous modernization of governmental infrastructure is a powerful, ongoing secular trend. While procurement cycles can, and do, introduce short-term volatility and lumpiness in project awards, the underlying demand for these services remains robust and is, if anything, likely to intensify as technology continues to evolve.

Turning to the Workday Services market, although it is acknowledged to be navigating a more challenged and competitive landscape currently – due in part to increased competition among partners and potential shifts in Workday's own partnership program strategies – the Workday platform itself continues to expand its overall customer base and global footprint. Workday, Inc., as a leading enterprise SaaS provider, has indeed publicly targeted a significant revenue growth 15% CAGR over the medium term . As the Workday platform continues its expansionary trajectory, there will inherently be a continued, albeit more competitively contested, demand for expert implementation, customization, and ongoing support services. Kainos, as a leading and experienced partner, remains well-positioned to capture a share of this evolving market, particularly for complex deployments.

And then, of course, there is the Workday Products division – a segment with demonstrably immense and multifaceted potential. This potential spans across several vectors: attracting new customers to its existing suite of well-regarded SaaS tools, upselling additional modules and enhanced functionalities to its current installed base of over 450 clients, and, critically, launching new, innovative products like the fifth one planned for release later this year. This division remains firmly on track to achieve its ambitious and publicly stated goal of £200 million in Annual Recurring Revenue (ARR) by the end of the decade. A significant, and perhaps underappreciated, catalyst in achieving this target is the enhanced sales support that Kainos is set to receive directly from Workday’s own extensive global sales force. This type of collaborative sales leverage from the platform vendor itself is an invaluable asset for any SaaS business operating within a larger ecosystem, significantly reducing customer acquisition costs and accelerating market penetration.

Given these persistent underlying positive dynamics across all three segments, incorporating even highly conservative growth assumptions into a Discounted Cash Flow (DCF) model can, and does, generate substantial potential upside for Kainos's valuation. A DCF valuation, by its very nature, seeks to quantify the present value of all future free cash flows that a company is expected to generate. It is, therefore, highly sensitive to the assumptions made about future growth rates, margin evolution, and the discount rate applied, but it provides a fundamental anchor for intrinsic value.

The provided analysis outlines a DCF model built upon the following key assumptions for its largest division, Digital Services, which are deliberately framed with a conservative lens:

Digital Services Growth: This segment is projected to grow at a modest 6% annually through to 2028 (the explicit end-year of this particular forecast period being 2028E).

Digital Services Margins: EBIT margins for this division are assumed at 27% over the forecast horizon.

It is crucial to contextualize these assumptions. The projected 6% annual growth rate for Digital Services is significantly slower than the segment’s historical 5-year average CAGR of 10% (achieved even before the COVID-induced surge and the more recent dip). It reflects a cautious outlook on the pace of recovery in public sector spending. Similarly, the assumed 27% EBIT margin, while representing an improvement from the current cyclically compressed level of 25.5%, is still well below the 34% peak margin achieved by this division in 2021. It also arguably sits below its normalized potential once project cadence and staff utilization rates fully recover.

Continuing with this conservative approach for the other divisions, the DCF model incorporates the following:

Workday Services Assumptions: Reflecting the current challenging market conditions, revenue in this segment is modeled to decline by a third over the next three years. Concurrently, EBIT margins are projected to fall to 13%, their second-lowest level in the company's history for this division. This explicitly bakes in a period of significant pressure and restructuring.

Workday Products Assumptions: In contrast, the Workday Products division is assumed to continue its growth trajectory in line with its stated targets, underscoring the strategic importance and momentum of this SaaS business. EBIT margins for this high-growth segment are forecast to reach a robust 29%.

Terminal Value Assumptions: Looking further out, the model assumes that the overall business fades to a 2% terminal growth rate by 2035, a standard assumption for mature companies. Long-term group EBIT margins are projected to stabilize at 18% by 2035. All future cash flows are then discounted at a Weighted Average Cost of Capital (WACC) of 8%.

These assumptions, particularly for Workday Services, are intentionally pessimistic in the near term, while still acknowledging the strong underlying growth engine of Workday Products and a reasonable stabilization for the group in the long run. Even with such prudence, the DCF reveals a significant undervaluation.

This approach further reinforces the overarching argument that Kainos is currently undervalued. If even a cautious, conservatively constructed outlook on the company’s future cash generation capabilities can justify a significantly higher share price than what the market currently assigns, it strongly suggests a material mispricing. The true intrinsic value begins to emerge when one combines reasonable, not overly exuberant, assumptions about the future with a clear-eyed assessment of current market sentiment and positioning. Kainos, with its blend of established service lines and a high-growth SaaS engine, appears to be a prime candidate for such a fundamental re-evaluation by the market. The disconnect between transient headwinds and long-term value creation potential seems particularly wide.

Conclusion: The Mispricing is Clear

The core argument presented here hope to transcends the debate about the timing and magnitude of Kainos's growth re-acceleration. Instead, a variety of valuation approach highlight that even a challenged environment Kainos appears fundamentally mispriced by the market. Regardless of one's precise short-term growth expectations, the current valuation fails to adequately reflect the intrinsic quality of its constituent parts, its established market positions, its robust financial health, and its clear pathways to future value creation, particularly within the high-potential Workday Products segment. For investors willing to look through the current cyclical fog, the disconnect between perception and reality offers a compelling opportunity.