SAP Q4: This is what a cloud transition looks like

How strong execution continues to define SAP's move to the cloud

Numbers

Key Updates

Revenue growth has strong foundations

Don't be fooled by the somewhat muted reaction to SAP's results. Investors may be focused on the somewhat slight deceleration in cloud backlog growth in 2025. This is a short-term view that in my view lacks a bit of perspective. SAP is executing extremely well and is in a great position to continue accelerating top-line growth and increase margins. There is also the potential of a burgeoning AI opportunity. These are the elements that make a successful cloud story, and I believe SAP's edition position still has a lot of value to produce.

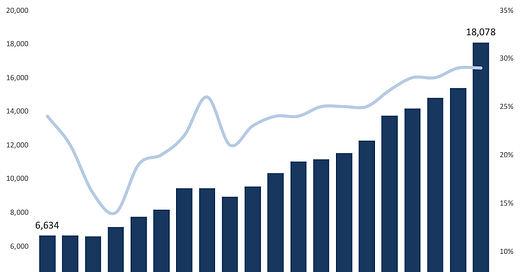

Any concern over decelerating cloud backlog should first recognise just how impressive the current level of growth is. SAP has now delivered 11 quarters of stable and or accelerating growth in its cloud backlog. Over that time, it has taken its backlog from €8bn to €18bn. This success was never a given, with considerable doubt as to whether SAP could ever successfully engage customers on the complexities of transitioning to the cloud. However, in committing to transforming its core ERP product around a cloud -native solution in S/4, then engaging with the complexities of cloud transition through the RISE program,SAP has created a winning formula that leans into the challenges of ERP cloud transition.

SAP Current Cloud Backlog Q1 2020-Q4 2024

SAP's management are clearly confident that this winning formula has further to offer. CEO Christian Klein commented:

“Our retention rates are getting better and better and so I feel the outlook is actually really ambitious. Also given, honestly, the macro environment and you see in the cloud revenue, there is no slowdown. This is actually an acceleration. And so, the 2 things coming together, higher retention, higher adoption, further acceleration of the customers who are already on the move to the cloud higher win rates in the different line of businesses.”

As we have seen from recent results in the sector, selling AI has been more difficult to sell to enterprises than many had expected. Both Microsoft and ServiceNow have reported weaker guidance as a result. However, companies still focusing on selling cloud transformation, such as Atlassian, have reported stronger performance recently. SAP's confidence is therefore backed up by a strong market backdrop and sales process that has been working up to now.

The revenue opportunity from further cloud transformation

The company continues to quote its cloud conversion multiple (ratio of customer spending on the cloud versus maintenance) at 3x. Applied to the remaining maintenance revenues at the end of 2024 (c. €11bn), there is a €33bn revenue opportunity still ahead of SAP.

Margins: The Silent Story of Efficiency

While the robust cloud growth SAP is experiencing remains the dominant narrative, the earnings call also highlighted that SAP is pairing it with the equally crucial element for a cloud story: margin improvement.

SAP's cloud gross margin expanded by 1.4 percentage points to 73.3% for the full year '24. Again, the driver of this has been a mixture of SAP's own execution of optimizing its infrastructure, the benefit of scale through centralization on the HANA database and the benefit from customers' adoption of multi-tenanted architecture. All of these features increasingly show that SAP has multiple tailwinds helping to drive the profitability of its cloud business as it scales.

Operating profit increased 25% for the full year to €8.15 billion. Execution from SAP played a part in the performance, with the two biggest drives on operating leverage being centralization of costs and efficiency drives across the business. Comments from CEO Christian Klein now suggest that the company may have another driver, the benefits of AI.

SAP has been implementing AI internally to "enable our business to scale quickly while keeping costs in check". Christian Klein noted that "in development, over 20,000 SAP developers use AI-powered tools, including Joule for Developer already today" leading to "average efficiency gains above 20%". Furthermore, "AI-assisted contract validation has reduced our average contract booking time by 75%" and "in the corporate functions, we have seen a tenfold productivity gain through AI-assisted quote-to-cash process automation".

What this shows is there are very strong foundations to SAP's operational leverage. Why investors should be excited about this is that if SAP margin gains follow similar patterns to other notable cloud transformation stories, margins have a lot further to run.

Large Cap Enterprise Software Operating margin, Year 1 - 10

To illustrate this**,** the chart above overlays SAP's operating margin from 2020-2024 against the three most high-profile SaaS transition stories, Microsoft, Adobe and Autodesk over the last 10 years, as all three companies successfully executed a transition to the cloud. Each of these companies saw operating margins expand close to 15 percentage points over that journey. As we stand today**,** SAP's margins have only expanded 4 percentage points from their trough. At this point, all the pieces are in place for margin expansion**,** but investors haven't, as yet, benefited from the results.

Is the AI story next?

SAP used its Q4 results to tease an update to its AI strategy. I have previously been quite critical of SAP's efforts on AI to date. For me it has been too focused on attempts to push a check-box product, namely its AI agent Joule, in front of customers. This is more about appealing to investors' captivation with AI rather than an actual strategy. However, comments by Christian Klein suggest that something new is on the horizon.

“Today, companies spend up to 50% of their IT budget on data and analytics. And despite all of that investment, so many companies fall short of realizing the potential of their data. Too often data stays locked in silos or stuck in so-called data swarms without business context. Companies have no complete view of their business that way and without access to high-quality data, AI agents stay far below their potential as well, according to the principal, garbage in, garbage out.

We will address these challenges in the data and AI space, with one of the biggest innovations SAP has ever delivered. We will harmonize structured and unstructured data, SAP and non-SAP data, always with the relevant semantics. And by that, we will make AI agents much more powerful.”

By making this statement, I believe Klein is potentially putting SAP as potentially charting a much stronger AI strategy for SAP. He is speaking directly to the fundamental enterprise data challenge that's been brewing for decades, and one SAP may be uniquely able to solve.

Let me unpack this strategically. The core problem is what I'd call "enterprise data fragmentation". Imagine large companies as massive, complex organisms where data is like blood flowing through different systems. Historically, these systems don't communicate naturally: Sales data sits in one database, manufacturing data in another, customer interaction data somewhere else, and Unstructured data like emails, reports, customer feedback scattered everywhere. When AI is used in this context, its understanding of the business is also based on these individual fragments of data. To use Klein's parlance, enterprises struggle to provide AI systems with the context of what is happening across their organizations. The result? Unreliable results.

I believe SAP may have a unique advantage in drawing these fragments together. They've been the backend system for enterprise operations for decades. They don't just understand data - they understand how businesses actually work. Historically, 80% of all transactions in a business touch an SAP system at some point. Now with the adoption of HANA continuing, SAP has a platform for real-time data processing engine designed to handle complex enterprise data landscapes. Furthermore, S/4 HANA is already integrated across multiple business functions.

What I think Klein is pointing to is that they're not just providing an AI tool, but creating an intelligent data translation layer. By creating a "semantic data layer" that can harmonize structured and unstructured data across SAP and non-SAP systems, they're potentially solving the most complex enterprise AI challenge: contextual intelligence. This isn't just an incremental improvement. This could be a fundamental reimagining of how enterprises use data and AI.

By pursuing this sort of strategy, SAP is positioning itself not just as a software provider, but as the critical infrastructure for how intelligent enterprises will operate in an AI-driven world. The real monetization isn't just in selling software - it's in becoming the essential platform that translates complex business data into actionable intelligence. They're trying to create a scenario where businesses can't imagine operating without their intelligent data layer. This could represent a multi-billion-dollar expansion of their existing business model, transforming them from a traditional enterprise software company to an AI-powered business intelligence platform.

I am eagerly awaiting SAP's business Unleashed Event on February 13 to find out more.

Impact on the Investment Case For the second quarter running, SAP has reported results that more than justify the investment case. The investment case remains very simple: SAP is in my view the next great cloud transition. The 3 elements of that story were on display:

SAP continues to execute on moving its business to the cloud, helping it to grow faster.

The company is also delivering on margin expansion, with a long runway for further gain ahead of it.

There is potentially new revenue opportunity beyond the cloud transition with a new AI strategy.

The near-term valuation remains high on 30x 2025 P/E on the strength of the fundamental underpinnings that valuation. As SAP should grow earnings over 20% over the next several years, there remains a very attractive internal rate of return (IRR) on offer. The company continues to be a key position for me.