Thoughts from the Pershing Square Holdings Annual Investor Meeting

Balancing Investment Excellence but with strategic execution concerns

I was fortunate enough to attend Pershing Square's annual investor meeting in London last week. As a long-time investor in the fund, the firm's investment process has significantly influenced my own investing philosophy and ultimately the investment process of Northwest Frontier Capital. It was valuable to hear from Bill Ackman and his impressive team as they outlined both the big picture developments at Pershing and recapped the investment cases for portfolio holdings.

Exceptional Performance Foundation: Pershing Square continues to deliver strong long-term returns (22.2% annually over 5 years vs. 14.5% for the index) through its focused strategy of investing in simple, predictable businesses at reasonable valuations.

Strategic Growth Initiatives: Ackman is pursuing multiple avenues for firm growth—a US fund launch, the Howard Hughes acquisition, and SPARC merger opportunities—each with meaningful implications for PSH shareholders but so far execution on each has been lacking.

Portfolio Evolution: The investment team is expanding its competence into digital platforms (Alphabet, Uber) while maintaining conviction in long-term holdings like Brookfield and Restaurant Brands despite challenges with investments like Nike.

NAV Discount Persistence: Despite share buybacks and growth initiatives, PSH continues trading at a significant -27% discount to NAV, representing both a challenge and opportunity for investors.

Performance & Investment Strategy

It's important to place the meeting in the context of Pershing's exceptional long-term performance. While they underperformed major indexes last year, their 5-year annualized returns stand at an outstanding 22.2% annually, versus 14.5% for the index. What's particularly reassuring is that Ackman drew a direct link between this recent performance and the core principles of the firm.

Source: Pershing Square 2025 annual investor presentation

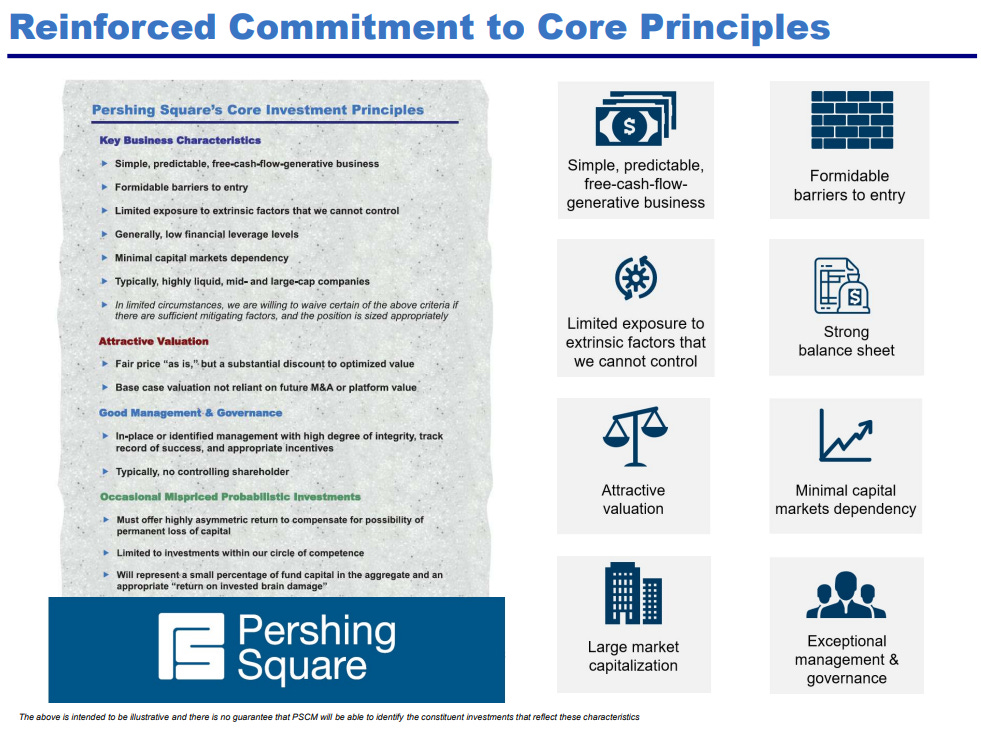

Ackman characterized Pershing Square's history in three distinct eras: the first 11.5 years of the firm, a challenging period from 2015-2017, and a recommitment to core principles beginning January 2018. This framing matters because Pershing's investment approach is genuinely distinctive.

The core principles are relatively simple: Ackman and his team look for simple, predictable, free-cash-flow-generating businesses and purchase them at reasonable valuations. I believe the "secret sauce" is their ability to identify when companies are making the necessary operational decisions to affect positive fundamental change. Purchasing these companies at relatively cheap valuations (often below market average) often drives returns from both accelerating earnings growth and multiple expansion. This approach is complemented by Pershing's ability to catalyze positive change through engagement with management teams and boards.

Source: Pershing Square 2025 annual investor presentation

The foundation of this process is the depth of research Pershing brings. They employ private equity-trained analysts skilled at analyzing operational decisions, then deploy them on a small number of names to maximize informational advantage. This approach is almost the antithesis of mainstream fund management, where managers are typically generalists who run large portfolios, conduct relatively little fundamental research, and make decisions based on relative performance rather than fundamentals. That's why Ackman's commitment to these principles is so crucial—they represent a real differentiator against most active managers. With this approach intact, Pershing should be able to continue producing above-average results.

Growing Pershing Square

A key topic Ackman discussed was Pershing Square's decision to grow the firm through 2024. Several strategic transactions have been either proposed or completed this year, including the launch of a US Pershing Square fund, the proposed takeover of Howard Hughes Corporation, and the ongoing pursuit of a potential merger for Pershing Square's SPARC company. All these moves are effectively attempts to broaden Pershing's investment strategies while growing assets, with implications for Pershing Square Holdings (PSH) shareholders.

Despite a high-profile failed IPO this summer, Ackman remains determined to launch a US-based fund to invest in public securities. He went so far as to state he was "un-cautiously optimistic" about pursuing a Pershing Square US fund with a new structure over 2025.

There would be an immediate benefit via fee reductions to PSH shareholders from the launch of a US fund. PSH would receive a rebate equal to 20% of both management and performance fees generated on any funds managed by Pershing Square launches that invest in public equities. This rebate could materially impact the fees on PSH, as demonstrated by the below slide the 2024 meeting.

Source: Pershing Square 2024 annual investor presentation

While potential fee reductions are always welcome, I remain concerned about how additional funds might affect PSH's investment strategy.

Ackman has routinely stated that Pershing's investment universe is constrained by their desire to remain a concentrated fund with meaningful ownership stakes and be an active, engaged shareholder. I worry that Ackman and Pershing may struggle to maintain all these features should a US fund significantly increase assets under management. Asset growth typically drags on performance, and the Pershing strategy seems vulnerable—potentially having to compromise on position concentration, engagement level, or seeing their investable universe narrow.

While the US fund IPO is somewhat on hiatus, Pershing is pursuing another transaction: the acquisition of Howard Hughes. Currently, Pershing Square is today offering $90 per share (raised from $85) to take the company private. While Ackman updating investors on the progress and strategy of the transaction today, he outlined the business plan to transform Howard Hughes into a diversified holding company last week.

Pershing's plan is for key investment team members (Ackman, Ryan Israel, and Ben Hakim) to effectively govern Howard Hughes' capital allocation. They'll become the management team of a holding company, Howard Hughes' Holdings, with existing operations becoming a subsidiary. This structure preserves Howard Hughes' core operations while allowing Ackman and his team to reinvest excess cash flow in purchasing controlling stakes in private businesses. I'm enthusiastic about this strategy—in addition to permanent capital, Pershing will gain access to a cash generation source while simultaneously expanding their potential investing universe to private businesses. Very few investors, outside of a well-known individual in the Midwest, have access to such an investment structure. Given Pershing Square's excellent track record and business analysis capabilities, powered by an investment team with private equity backgrounds, I'm genuinely excited about this potentially becoming the next era in Pershing's investment strategy. However, I have one major reservation.

The fact that Howard Hughes, after development costs, is barely free-cash-flow positive raises questions about what capital Pershing will have to invest. Howard Hughes points to illustrative cash flow of $553 million after recurring expenses as a rough guide for free cash flow generation. However, on a trailing 12-month basis, there have been over $750 million in either property development expenses or asset acquisitions. A situation exacerbated by the c$50million of fees Pershing Square expect to charge annually. This highlights Howard Hughes' fundamental challenge: all (and more) of its cash flow has been absorbed by property development opportunities. This creates a potential problem for Ackman and Pershing—the capital required for any private company investment strategy might deprive Howard Hughes of capital for its core activities. That would be problematic if Ackman hadn't been telling us that Howard Hughes was vastly undervalued and had great opportunities to deploy capital in its core operations.

Howard Hughes illustration of Cashflow generation

Source: Howard Hughes Investor Day presentation

This represents an inherent flaw in using real estate ventures as a capital source. Consider our famous Midwestern investor—he receives an income stream in return for the risk of paying a future uncertain liability and invests the float for return in the interim. Real estate is essentially the opposite: a significant upfront cost in development expenses in return for rental income (or sale) that can be uncertain due to market conditions once development is complete. While I'm positive about Ackman's capital allocation abilities, I don't believe those skills have found their ideal structure in Howard Hughes.

Ackman was also asked for updates on Pershing Square SPARC Holdings. The special purpose acquisition rights company launched in September 2023 with the aim of merging with a private company to take it public. Fifteen months later, there's been little new information on potential deals. Ackman noted that while there had been substantial communication with prospective merger targets, Pershing often valued these businesses below the carrying values of their private equity owners. He mentioned that the SPARC efforts complemented other Pershing strategies: SPARC targets larger transactions and brings companies into public markets, while Howard Hughes would focus on smaller companies remaining private. The two structures maximize Pershing's transaction flexibility by offering different outcomes to potential companies.

The SPARC remains poorly understood by PSH shareholders. Most don't realize that PSH is entitled to sponsor warrants granting up to 4.95% of outstanding shares of whatever company it merges with, though these are only exercisable three years after the merger at a price 120% above the listing price. Regardless, exercising these warrants would significantly impact NAV. By my calculations, even at the stated minimum $1.5 billion transaction size, the sponsor warrants would add 1.2% to Pershing NAV. With larger transactions, the NAV impact grows—worth remembering that Ackman's closest transaction under the previous SPAC structure involved purchasing 10% of a company at a $42 billion valuation. This gain would complement any NAV growth from shares purchased at listing under forward purchase agreements.

PSH shareholders should therefore view the SPARC as a unique option within the portfolio. However, the lack of visible progress on transactions, combined with management attention seemingly directed to new initiatives, reduces visibility on potential timing. Given Pershing's somewhat poor execution on large strategic transactions over several years, in my opinion, they should focus on completing what could be a very lucrative opportunity for PSH shareholders rather than creating new ones.

NAV Discount

A continued source of frustration for both investors and management is PSH's significant discount to net asset value. Currently, PSH shares trade at a -27% discount to latest NAV. The reasons include fees, Pershing Square's size, its >15% gearing, and the lack of a natural asset base in Europe/UK for a manager like Ackman. However, a nearly 30% discount on high-quality listed large-cap American stocks is extreme.

Source: Pershing Square 2025 annual investor presentation

Pershing is employing several measures to narrow this discount. The US fund is partly a plan to use US capital to address the discount, with potential fee rebates and arbitrage opportunities attracting new PSH buyers. Ackman pointed to discount narrowing during the fund launch process as evidence of this potential. In my view, this approach likely represents the best way to reduce the discount. UK and European markets lack the marginal buyer for Pershing's assets—most investors prefer more diversification, more tech exposure, and a less high-profile manager. This demand shortage ultimately weighs on PSH's shares price.

Pershing has, however, used the discount effectively. They've repurchased 64 million shares outstanding at an average price of $47 and average discount to NAV of 29%. This has reduced the share count by 27% and resulted in Pershing Square employees owning around 27% of the vehicle. Ackman suggested buybacks would continue but ruled out a forced liquidation strategy where the fund's assets would be sold and reinvested into PSH shares until eliminating the discount. While these buybacks haven't eliminated the discount, they've added substantial shareholder value by increasing ownership in businesses that continue to compound and further aligning management with fund performance.

Portfolio Updates

The presentation featured an in-depth review of each portfolio holding by Pershing CIO Ryan Israel. He's an impressive executive who discussed each position in detail with minimal notes and spent hours afterward fielding investor questions. While Israel lacks Ackman's profile, I believe Pershing's portfolio may benefit from another exceptional investor deserving closer attention.

Below are notes and thoughts on select interesting investment cases from the Pershing portfolio.

Alphabet

Source: Pershing Square 2025 annual investor presentation

I must disclose that Alphabet is a Northwest Frontier Capital holding. Consequently, I'm slightly biased in my appraisal and found myself agreeing with much of Pershing's presentation, though I was somewhat disappointed in their approach.

Pershing's investment case represents the standard bull argument: Alphabet trades at a discount to its valuable assets because investors are overly focused on AI threats to the core search business and fail to recognize Alphabet's own AI leadership. Pershing focused on the dramatically falling cost of serving AI overviews in search over the past year, while monetization of AI overviews tracks in line with regular search ads. These are valid arguments, but they're sourced from management statements without demonstration of proprietary research from Pershing.

There's nothing wrong with an investment case based on widely recognized features—there are no points for originality—but it represents a missed opportunity given Pershing Square's platform. I've outlined my own Alphabet views to many long-only investors recently. A key issue is that most investors are blinded by AI risk to search, failing to see that Alphabet possesses all necessary assets across models, infrastructure, distribution capabilities, and applications to drive very low AI service prices and thus ward off competition. Pershing, with its reputation for detailed work and large following, has the opportunity to guide investors through this debate and potentially convince them to revalue the shares.

Brookfield

Source: Pershing Square 2025 annual investor presentation

Despite being one of Pershing Square's largest positions, Brookfield seems somewhat overlooked in the portfolio. This is surprising given its compelling investment case. Brookfield is a leading alternative asset manager whose primary asset is a 73% stake in Brookfield Asset Management, alongside operating businesses across Renewables, Infrastructure, and Real Estate. The core thesis is that fee income and carried interest realization are driving significant growth in distributable fee income from BAM and other Brookfield assets. This represents an asset-light, high-margin recurring income stream that should produce 30% of Brookfield's market cap in cash over the medium term. Despite this, its valuation sits at a significant discount to listed US peers like KKR or Apollo.

Brookfield shares many characteristics with Pershing's most successful investments. It's an under-owned and under-researched asset where Pershing is applying analytical resources to identify mispricing. What's compelling about this case is its mechanical nature—fees will generate substantial excess cash flow because of Brookfield's corporate structure, with relatively little operational execution required for Pershing's thesis to play out. However, most investors haven't dedicated the time or resources to understanding this, creating potential return opportunities for Pershing.

Restaurant Brands

Restaurant Brands represents one of Pershing Square's longest-held investments but has been problematic recently and was one of the biggest performance detractors last year. The investment case is largely valuation-based, with Restaurant Brands trading at a significant discount to peers. This stems from historical underperformance versus the sector, although the company is now outperforming ambitious internal targets that themselves exceed sector averages. Pershing's core thesis is that this improved performance should drive multiple expansion.

Source: Pershing Square 2025 annual investor presentation

Restaurant Brands displays many qualities of successful Pershing investments. Pershing has a strong QSR sector track record, has been involved in hiring an exceptional CEO, and is adding value through engagement on matters like index inclusion. Given the stark discrepancy between Restaurant Brands' performance and valuation, the ingredients appear present for strong future performance.

Nike

Source: Pershing Square 2025 annual investor presentation

The Pershing team acknowledged Nike has been a difficult investment to date. They attributed this entirely to the previous management team, described as "doing everything possible to destroy the brand." However, they believe that under new CEO Eliot Hill, the company is taking necessary steps to reverse the damage. Pershing seems very confident in Hill’s ability, sharing that he had possibly the best feedback from expert calls on management the analyst had ever done. Hill is already putting in place measures to improve performance, including reduce inventory in key lines like Air Force 1, ending discounting on Nike's DTC channel, and rebuilding relationships with key retail partners. Pershing ultimately believes the market fails to recognize Nike's competitive advantages, whether in its extensive retro style library for fashion trends or leading running technology. They also believe margins, affected by previous mistakes and remedial actions, currently trade at half their steady-state level.

While much of the Nike investment case makes sense, substantial turnaround risks exist. Nike's new management has already indicated that inventory correction and branding efforts would likely take until 2026 to yield results. Furthermore, valuation pressure remains a concern—Nike's competitor Adidas ultimately bottomed at 1x sales versus Nike's current 2.5x. With limited earnings trajectory visibility short-term and potential for further multiple compression, I see substantial risk in the Nike position.

Uber

Source: Pershing Square 2025 annual investor presentation

Pershing also presented its latest investment, Uber Technologies. The investment case is straightforward: Uber's platform represents a strong ride-sharing franchise with network effects enhancing its position. The ride-sharing market offers significant TAM opportunity for Uber's growth. The company has a long runway to increase revenue through customer growth and ARPU. Margins have upside through cost discipline, and the company has growing resources for share buybacks. However, it trades at a low valuation due to autonomous vehicle (AV) concerns, which Pershing views as limited. Pershing believes the company can achieve its target of >30% annual EPS growth over the next several years and potentially double its stock price over a three-year horizon.

Regarding AV risk specifically, Pershing outlined several mitigating factors: the valuation associated with Uber's 20% take rate (demand aggregation, technology stack, fleet service partners); insulation from whole AV competition due to geography and regulation; and the potential for AV to ultimately expand the ride-sharing market. These points appear well-considered and credible.

Source: Pershing Square 2025 annual investor presentation

I have mixed thoughts about the Uber investment case. On the positive side, the thesis resembles that of Alphabet, showing growth in Pershing's investment process. The team has clearly leveraged their research and understanding of Alphabet to get comfortable with another digital platform. Having historically avoided digital businesses, making several such investments in recent years demonstrates the team's expanding competence into new market segments. However, I'm concerned about the background context. Ackman originally had a high-profile exchange with Uber's CEO on Twitter regarding driver compensation, making their substantial investment several months later appear somewhat suspect. The concern is that the lines between Ackman's personal social media use (which he has repeatedly described as personal) and Pershing Square's investment process are blurring. While Twitter represents an incredibly powerful tool, finding ideas through social media and then engaging management exemplifies problematic behaviour seen from less process-driven (boomer) fund managers who rely excessively on personal opinions. I sincerely hope Ackman isn't demonstrating such tendencies.

Conclusion

As I reflect on the Pershing Square annual meeting, three key takeaways stand out. First, PSH remains an exceptional investment opportunity—offering access to a management team with a stellar track record and a differentiated investment process, all available at a substantial discount to NAV. Few investment vehicles offer this combination of proven talent, disciplined methodology, and valuation cushion. Second, despite these strengths, Pershing's execution on major strategic transactions has been disappointing. From the failed US fund IPO to the slow progress with SPARC and questions surrounding the Howard Hughes acquisition, the firm's ability to execute complex corporate actions hasn't matched the excellence of its core investment process. Finally, Ackman's increasingly active Twitter presence represents a growing concern. The blurring lines between his personal social media commentary and Pershing's institutional investment decisions—as exemplified by the Uber situation—introduces a new risk factor that bears watching. While Pershing Square remains one of the most compelling investment managers available to public market investors, these emerging concerns warrant continued monitoring as the firm evolves beyond its traditional approach to capital allocation.