Trainline's H1 Trading Update: A Misunderstood Journey

Why the market has overlooked this platform's hidden power

There's a peculiar contradiction at the heart of Trainline's recent trading update: the company is delivering exactly what it promised, yet the market appears determined to punish it anyway. This disconnect reveals something fundamentally interesting about how investors perceive platform businesses in regulated markets, particularly when those businesses demonstrate strong economics in the presence of regulation.

Trainline is demonstrating fundamental strength in both UK and international markets, with investors mistakenly interpreting shifts in growth composition as structural weakness

The company's international segment is showing accelerated progress toward profitability despite short-term growth challenges, validating its economic model in Europe

Shareholder returns are well-supported by Trainline's financial trinity: strong free cash flow, positive working capital dynamics, and a nearly net-cash balance sheet. This could enable a 60% reduction in shares outstanding.

Now trading on just 7.7x EV/EBITDA, Trainline's valuation is currently the lowest of any European online classified. This significant valuation discount represents an opportunity, especially given intact growth prospects, strong margins, and potential interest from private equity and strategic buyers

The UK Story: Mature Growth vs. Structural Decline

The reaction to Trainline's UK business performance presents the clearest example of this misalignment between fundamentals and perception. Growth has largely tracked with expectations, though momentum has admittedly weakened in the second half of the fiscal year. The causes behind this deceleration are worth examining. Consumers have shifted toward purchasing habits with lower take rates, reducing net revenue, as the company has gained market share in lower-margin verticals such as commuter travel or on-the-day travel. Furthermore, the ancillary revenue streams introduced over the last year have become less effective at offsetting these trends, possibly indicating that ancillary revenues have saturated quickly.

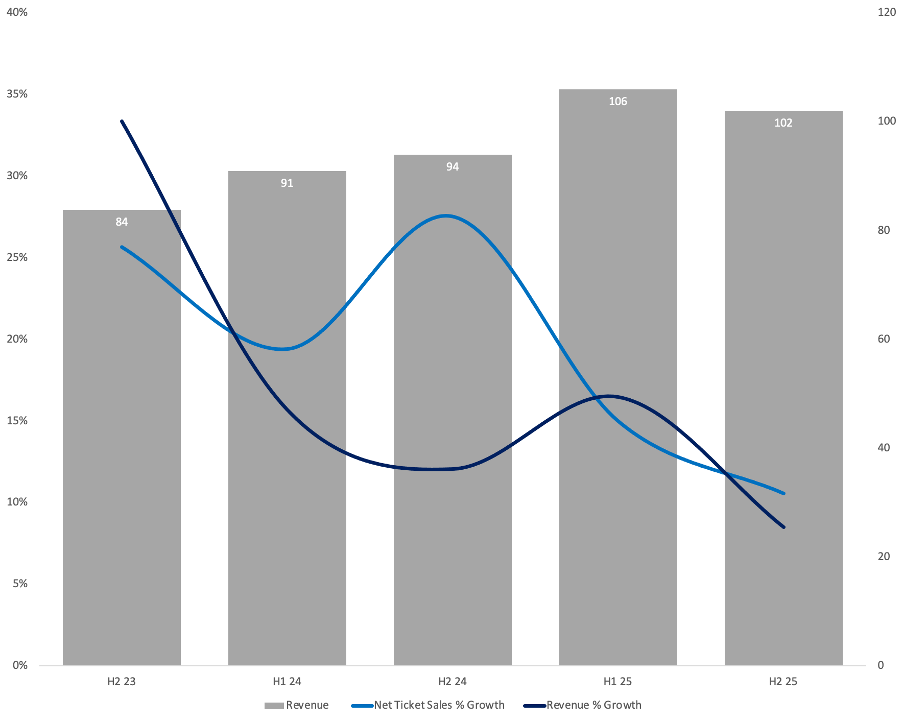

Trainline UK Consumer Sales + Net Ticket Growth H2 FY23- H2 FY25

This situation presents something of a strategic catch-22 for Trainline. The company has successfully expanded its market share in non-traditional segments, which should be celebrated as a sign of business resilience and adaptability. Yet investors have perversely framed these gains in low-take-rate areas as a negative development. This reaction suggests a fundamental misunderstanding of aggregation economics— Trainline's high share of demand eventually aggregates all supply to where demand can be accessed, hence why non-traditional ticket types are present on Trainline. Supply is being forced onto Trainline's platform like a gravitational pull. It is a sign of a very powerful position the platform is in, even if it is a temporary headwind to revenue growth. Increasing market share from aggregating supply is in my opinion not a sign of structural pressure but of Trainline's competitive moat growing.

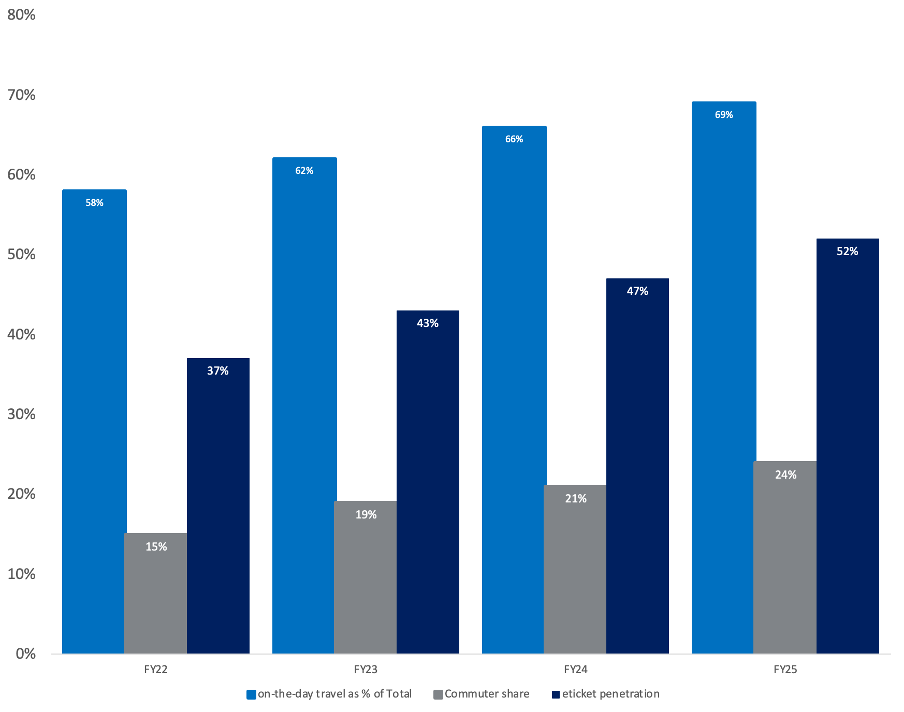

Trainline Share of UK Rail Ticket Types

What's particularly striking is that there's nothing structurally concerning about Trainline's UK performance. While momentum has slowed, especially in advanced ticket sales, the UK business is mature. What I believe investors have underappreciated are the strong underpinnings for this mature business to continue to grow at a mid-to-high single-digit rate. Several factors support this outlook: scheduled rail price increases will flow through to revenue; passenger volumes have room to grow as return-to-office trends stabilize and strike activity diminishes; and reduced customer acquisition spending from competitors like Uber creates space for more efficient marketing. The UK segment has outperformed expectations over the past couple of years and is now simply normalizing to a sustainable growth trajectory.

Investors who interpret these results as the first signs of secular decline are missing the forest for the trees. They're failing to recognize the robust foundation supporting Trainline's mature UK business. This reaction exemplifies a common error in evaluating platform businesses: confusing a shift in growth composition with structural weakness.

International Challenges: Short-Term Pain for Long-Term Gain

The international segment presents a more complex picture and is the primary reason for the overall revenue miss. Both net ticket sales and revenue turned negative in the second half, which naturally raises concerns. However, understanding the context is crucial. Europe has traditionally been a web-based market for ticket sales, with national carriers historically offering limited mobile or app booking options. This created an opportunity for Trainline to aggregate these fragmented services. Now, Google has altered its algorithm to prioritize direct bookings with carriers—a challenge facing online travel agencies (OTAs) broadly.

Trainline International Consumer Sales + Net Ticket Growth H2 FY23- H2 FY25

This shift presents short-term difficulties for Trainline, as low app penetration limits their reach while they simultaneously lose revenue from traditional web bookings. However, paradoxically, Trainline is positioned to emerge stronger from this transition. The company benefits from exceptionally high app usage among its customer base, putting it ahead of the curve in adapting to this new reality. App usage statistics show impressive engagement, suggesting a strong foundation for future growth.

Trainline App purchases as % of total revenue versus OTA Peers

What's happening here is fascinating from a platform theory perspective: market forces are effectively pushing Trainline into becoming a better business. Over the long term, the app-first approach will reduce traffic acquisition costs, foster more direct consumer relationships, and create additional monetization opportunities. This parallels the evolution we've seen in other travel verticals, where companies like Booking.com and Expedia have prioritized direct channels to mitigate their dependence on search rankings. In this context Trainline also displays better economics with its share of in-app purchasing significantly higher than either Expedia or Booking. Better economics is ultimately an indication that Trainline could be able to reaccelerate growth, and diminish the impact of Google over time.

Meanwhile, structural changes in European rail continue to accelerate. Increased carrier competition is expected to intensify over the next several years, creating more opportunities for an aggregator like Trainline. Carrier competition is increasing in density in Spain, Trainline's fastest growing European market. National carriers in Italy and France are launching services in each other's markets in 2026 and 2027. Long-term, competition will also be coming to international services like the Eurostar. The market structure is clearly heading in Trainline's direction, with fragmentation creating precisely the kind of inefficiencies that aggregators thrive upon. With Trainline showing the capability of capitalizing on this change in structure through its superior user experience and cross-border functionality, Trainline's growth prospects in Europe are undiminished. This is the classic aggregator advantage at work: as the underlying market becomes more complex and fragmented, the value of a unified interface that abstracts away that complexity increases exponentially, driving more users to the platform and strengthening its competitive moat.

Management is making the prudent decision to preserve marketing efforts for long-term prospects rather than chasing short-term revenue—a strategic choice that exemplifies the patience required to build sustainable platform businesses. As a result, margin progression in the international business is occurring much faster than anticipated. The segment is now EBITDA profitable on a pre-internal transaction fee basis. This accelerated progress toward profitability validates the economic model in Europe, investment in growth and user acquisition, followed by margin expansion as network effects take hold and scale economies manifest. Disappointment in short-term growth therefore should be measured against the fact that the international business is displaying the pathway to sustainable profitability.

In the context of Trainline's platform economics, this strategic patience is precisely what creates long-term value. With market structure trending favourably and a business model proven to generate margins approaching 40%, the company's measured approach to growth investment isn't a weakness—it's disciplined capital allocation at work. Investors fixated on quarterly growth metrics are missing the forest for the trees; the platform with the best unit economics and strongest user experience will ultimately capture disproportionate value as the European rail market fragments further.

Margins and Capital Returns: The Hidden Strength

The company's disciplined approach to marketing spending in its international markets has contributed to an improved margin profile for the business. In fact, Trainline has upgraded its margin expectations yet again, despite revenue tracking at the lower end of its expected range. This demonstrates that the business maintains tight cost control and substantial profitability—a critical consideration even for those who believe Trainline faces structural challenges. A business that can generate substantial profits even in a hypothetical decline scenario offers significant downside protection.

Investors have expressed disappointment at the lack of an increase to the share buyback program, but this reaction overlooks the significant capacity for shareholder returns over the coming years. Trainline benefits from a powerful financial trinity: continued free cash flow generation, positive working capital dynamics, and a near net-cash balance sheet. These factors combine to give the company substantial resources for future capital returns.

Trainline has substantial Capacity to pursue shareholder returns

On top of the existing share buyback program Trainline has has significant capacity for further Buybacks. I estimate that ongoing FCF generation and leveraging the company to 1x Net/EBITDA would allow for over £800m to be returned to shareholders by FY30. This would prove highly accretive, with as much as 60% reduction in Trainline’s outstanding shares. Even if growth prospects for Trainline where diminished the classic story of using excess capital from a highly profitable to continually accretive EPS still exists.

Valuation: Discount Presents Opportunity

The market's reaction to Trainline's latest update reveals a fascinating disconnect between narrative and reality. Investors have constructed a story around Trainline as a structurally challenged business and are using what is ultimately an in-line statement to further de-rate the shares. This narrative fails to account for the company's demonstrated resilience, operational discipline, and strategic positioning.

Trainline currently trades at a significant discount to other platform peers, despite maintaining good growth opportunities. This valuation gap appears increasingly irrational when considering that the structural underpinnings behind international growth remain intact, the UK business shows no evidence of structural issues, and margins continue to surprise to the upside.

Trainline EV/EBITDA versus European Platforms and OTA Peers

There are multiple paths to realising value from here. Trainline can continue to deliver strong operational performance, gradually forcing the market to recognize its true worth. The company can accelerate its share buyback program, creating value for long-term shareholders. And ultimately, at this valuation, Trainline will inevitably attract attention from both private equity and strategic buyers who recognize the disconnect between the company's intrinsic value and its market price.

The Trainline story illustrates a broader truth about platform businesses: the market often struggles to properly value companies that operate at the intersection of technology and traditional industries, particularly when they challenge established monopolies through aggregation. By focusing on short-term fluctuations rather than long-term structural advantages, investors risk missing the forest for the trees. For those willing to look beyond the prevailing narrative, Trainline represents a compelling case study in misunderstood platform economics—and potentially, a significant investment opportunity.