YouGov's Meta Moment

Summary

· YouGov’s profit June profit warning has sparked numerous concerns about the company’s future. We believe investors may be overestimating these risks.

· Competition has had a impact in the short-term, but YouGov has a number of long-term competitive advantages over the new entrants

· The newly acquired CPS business is better positioned than investors perceive

· Investors are underestimating YouGov’s ability to generate cost savings to support its margins.

Post the warning

It has now been 6 weeks since YouGov, a top 5 position, announced a material profit warning. Through a combination of shortfalls in revenue and ongoing cost increases, the company reduced its profit expectations by 40%. As a result, its shares have declined by 46% and investor concerns about the company’s future are mounting.

It’s nothing we haven’t seen before- in fact, we have seen it a few times, mostly famously when Meta equity’s story became challenged during 2022. We can pick out a lot of similarities that caused the decline of Meta’s stock with YouGov’s current situation.

Similarly to YouGov today, investors questioned Meta’s long-term growth potential in the face of competition and were concerned over margin trajectory after significant cost increases, with little confidence in any return on the spending. Ironically, the parallels also include YouGov’s relatively new CEO, Steve Hatch, previously ran Meta’s Northern Europe region prior to joining YouGov. Through 2023 and 2024, Meta turned around their position and continued to grow their revenue by tightening spending and improving profit margins, while easing concerns over competitors.

Currently, YouGov’s investors face the same despondency that Meta’s shareholders faced in 2022, which is reflected in the 11.5x forward earnings ratio the company is now valued on. Despite the concerns around lack of visibility and the loss of faith in management, there is still reason to believe YouGov has all the right foundations for success.

To begin with revenue trends. After years of consistently hitting growth expectations YouGov reduced its revenue expectations by 4% to £324m-£327m. The combination of heightened competition for its Data Products segment and commercial issues affecting larger research projects drove this miss.

Competitive landscape:

One of the key concerns from investors is that YouGov’s most profitable division, Data Products, is now under serious competitive pressure. However, looking at this competition in more detail, it’s not one I share. YouGov success in the digitising market research has attracted companies looking to do the same thing, with two key competitors emerging: Morning Consult (MC) and GWI.

There are some important differences to note in the business models of YouGov and its competitors, particularly when it comes to data gathering. Morning Consult and GWI both have do not have their own panels, instead of purchase data through 3rd party data exchanges (in GWI/MC’s case, Dynata). In the short term, their avoidance of upfront capex into building their own data collection infrastructure has made both GWI and Morning Consult incredibly scalable competitors. No panel investment means GWI and Morning Consult can be faster to market with product and reinvest every dollar into product innovation or growing customer acquisition.

GWI and Morning Consult have leveraged this lower upfront cost to great effect. Their products are designed to be stripped down data sets, providing only the most necessary data to customers. This has a cost advantage with MC/ GWI subscriptions priced on a per seat basis for around $2k versus YouGov’s multi seat licence for upwards of $25k. The low cost also means that MC / GWI can be purchased almost on a one-off basis. If marketers are simply looking for one narrow set of data, say to populate a presentation, the subscription is low cost enough that it will fulfil that need.

What has further impacted YouGov is that both competitors are aggressively discounting their products against YouGov. When speaking with recent adopters of Morning Consult, we have learned that the company has offered discounts of up to 50% after finding out they are pitching against YouGov. It seems that these competitors are relying on discounting to complete sales, something unsustainable in the long term.

What makes GWI and Morning Consult effective competitors in the short-run may also act against them over the long-run. Both competitors run into the problem of how they can deliver additional value to customers. Not only is additional data and functionality not available with their products, it is not even collected.

Both MC/ GWI may encounter the biggest issue with 3rd party panel use, the consistency and quality of data from data marketplaces. As these data exchanges do not draw from a consistent population or know the underlying methodology used to collect the data. This may not be a large issue if customers are looking at one basic data set but it will yield inconsistent results with larger data sets. As a results of this 3rd party data use these competitors may find the products reduce in quality as they look to provide additional value to customers. Something YouGov’s CEO highlighted on the company’s H1 earnings call….

“What we do see, if we lose out to those other competitors is actually clients do come back later on when they understand the difference in quality. It's often a very difficult thing for clients to understand when you're assessing a new product is one is the actual underlying quality when you start using it in [earnest ], are you getting the insights that you would be expecting and we do have strong confidence that our products continue to be the highest quality in the market”

By contrast, YouGov already offers a mature product that is seeing increasing adoption from some of the most sophisticated users in market research. They also have the ability, thanks to the flexibility of their data collection, to reach downmarket and provide simpler tools to directly contend with their new competitors. YouGov has already launched Category View a new MC/ GWI rival product, and free Lite versions of its BrandIndex and Profiles solutions. This demonstrates an imbalance in the competitive dynamics between YouGov and other market players: YouGov can fully replicate the MC/ GWI ‘s strengths, but these new competitors will struggle to continue to compete.

Pressure from these new competitors is forcing YouGov into being a more modular, agile company. YouGov has significant advantage against most market research companies with the depth and breadth of its data. By taking an approach that disaggregates that data, initially to respond to GWI/MC, they will ultimately expand their potential customer base.

The long-term sustainability of MC / GWI is also questioned by their current financial position. Both are loss-making businesses. Morning Consult had to make several headcount reductions over the last year. There are also rumours that GWI is looking to sell itself. Despite their impact on YouGov these competitors are still struggling, and the question remains on whether they will be able to remain competitive going forward.

I believe the perception of competitive threat on YouGov is exaggerated. The company is facing competitors with lower quality products that still struggle to deliver additional value to customers and are relying on discounting despite financial pressures. In this context, I believe YouGov is not facing disruptive competitors, but rather is in the middle of a price war. Often price wars are won by the company with the most resources. Which leads onto the next investor concern, its acquisition of CPS.

CPS – the next shoe to drop?

Last July YouGov announced that it was acquiring the consumer panels services business of GfK, one of the leading European market research companies. The acquisition is the largest in YouGov’s history and will represent roughly 2X% of its sales going forward. The scale of this acquisition, YouGov’s use of leverage and CPS’s current growth profile has resulted in investors viewing CPS as another source of risk for YouGov.

There is an ongoing narrative that CPS was a legacy, non-core asset for GfK and concern has risen that there is a substantial risk of margin’s been overstated because of lack of investment. However, this misinterprets the nature of sale process. CPS was sold due to competition concerns from European regulators over GfK’s acquisition by Nielsen. CPS was carved out from GfK and sold to YouGov because of their financial capacity and the lack competition concerns from its ownership. In my view, investors are overestimating the risks associated with CPS.

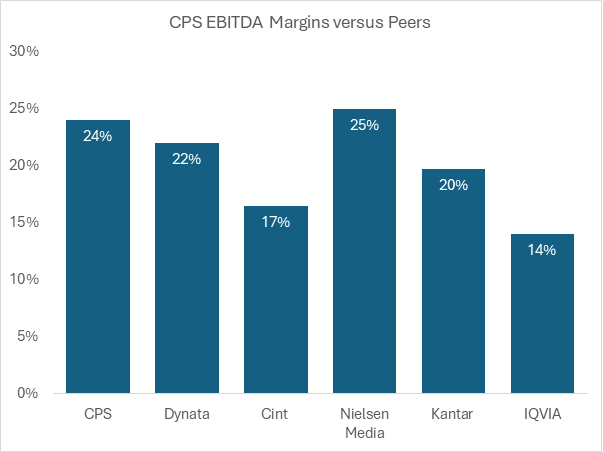

Firstly, there is no evidence that CPS is currently over earning versus market research peers, a key indicator of underinvestment. Using the last full year of historical margins for CPS under GfK ownership (2022) and comparing these to market research peers, we can see that CPS’s margins were largely in line with others. This gives us more confidence that CPS’s margins are sustainable at the current levels.

Investors are also concerned that CPS may see a downturn in revenue in the near term. In my opinion, CPS is a highly defensive business with a 90% recurring revenue business, 99% gross revenue retention and 3-year average contract length with 31% of its revenue coming from large multinational companies. Furthermore, use of transactional data is mission critical to several workflows, from developing new products to calculating purchasing incentives to retails. Therefore, I believe CPS sales will stay relatively robust even in a challenging macro environment.

Overall levels of growth are also concern for investors. Current expectations are for CPS to grow at c.4% over the next several years. This level of growth has led to the assumption that CPS is a legacy business, incapable of growing faster because of competitive dynamics. I don’t agree with this interpretation. GfK‘s expected growth is in line with forecasts for market research industry spending growth. Highlighting that CPS is not losing share, and we believe the lack of growth is for different reasons.

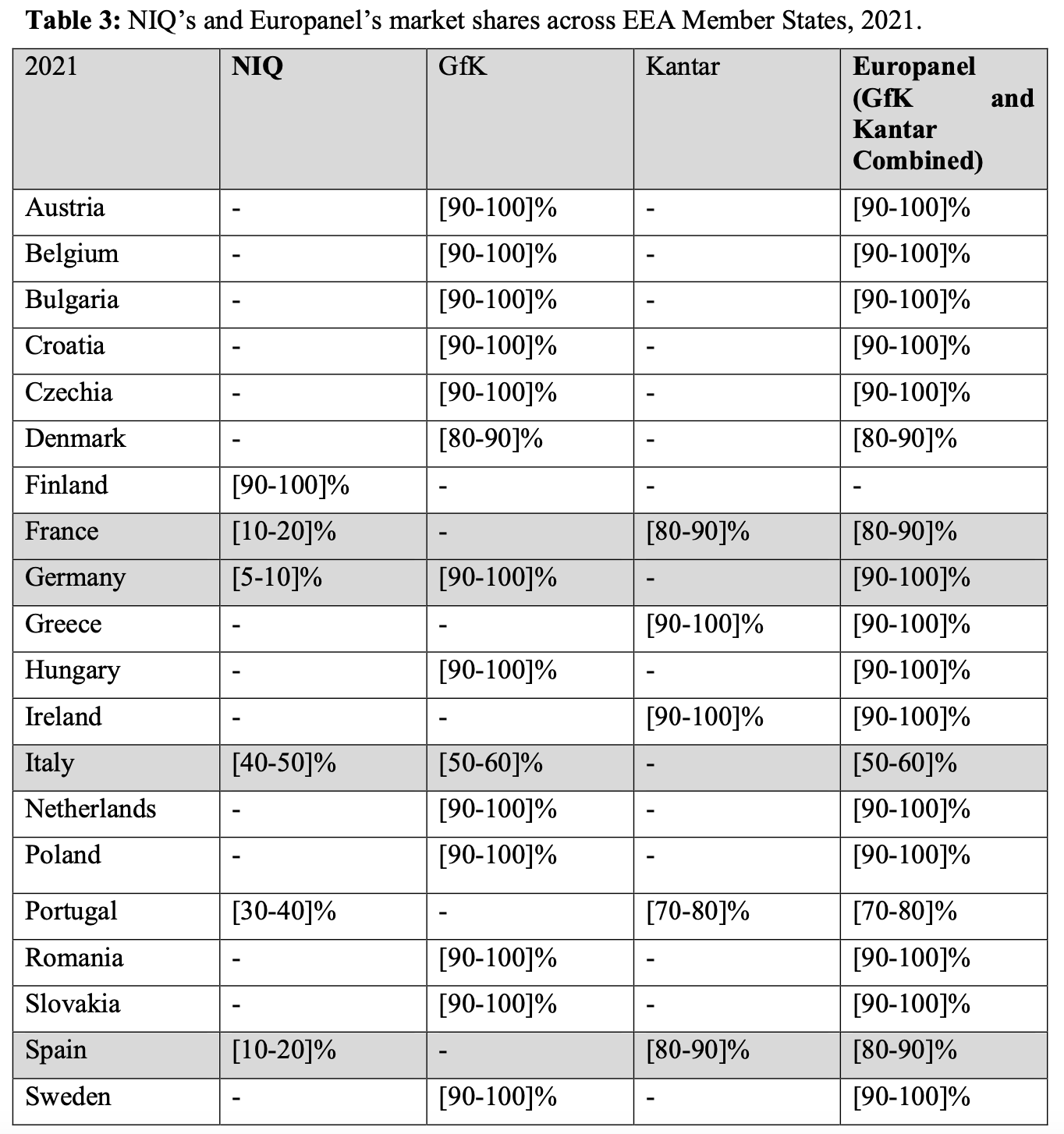

My view is that CPS growth rate is largely a function of market saturation, with the company having a dominant position in a relatively narrow number of markets, mostly in Central and Eastern Europe. As seen by the European Commission’s report into the retail measurement, GfK, Nielsen and Kantar have very little overlap in operations and GfK enjoys a virtually dominant position in all major European markets where it is present, but no share outside of this. Its combination with YouGov will allow entry into these markets for the first through YouGov’s existing panel presence. Perhaps more importantly these competitors will be at a disadvantage as they have not maintained their own infrastructure in GfKs market, instead using sharing panel across the market. YouGov existing panel therefore is a significant lever to allow GfK to fully compete with NielsenIQ and Kantar across Europe, and ultimately globally.

The final concern around CPS is the leverage YouGov has taken to acquire CPS. The company has borrowed over EUR250m to fund the acquisition, turning a net cash balance sheet to one with an estimated 2.4x of leverage at the end of FY24. However, with a rapid de-leveraging profile, I believe investors’ concerns will be alleviated quickly.

The graph below highlights that even with no margin improvement and 4% group revenue growth next year, YouGov should still achieve over half a turn of de-leverage. Any acceleration in growth or improvement in margins would likely reduce debt.

Source: Comapny Data

There is one caveat I will make to this assumption: with the first 32mEUR in YouGov’s term loan due in October 2024, liquidity during H1 is tight. We are unlikely to see an instant turn around in Data products growth, leading to possible working capital outflows. There may also be additional one-off charges for cost restructuring, representing further cash outlays, with the benefits likely to be realised outside of H1. Therefore, there is likely to be a significant drain of YouGov’s cash resources during H1 which may impact de-leveraging.

Margin levers underestimated

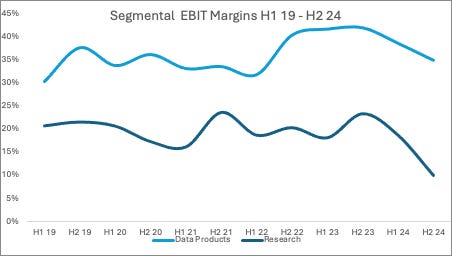

The most immediate and critical investor concern is over YouGov’s margin profile, the main driver of the company’s profit warning. As seen on the chart below, YouGov saw a steep decline in H2 24 margin as cost increases were made ahead of revenue growth that failed to materialise. I believe investors are now discounting margins staying at these levels in perpetuity. In my view, this overlooks the resources YouGov has to re-establish higher margins.

YouGov remain an inherently profitable company, with gross margins remaining high, giving the company more opportunity to address its costs. YouGov’s gross margins have remained at above 83% for the last five years. This level of profitability gives YouGov more control over its margin profile and captures a large amount of discretionary spending at the company.

A specific example of a cost areas where investors are underestimating the potential for savings, is central costs. The cost areas have grown at a 22% CAGR over the last 3 year, driven by director remuneration. This remuneration now accounts for 50% of total central costs. We estimate that 60% of this remuneration is performance based through combination of annual bonus a LTIP. Given profitability targets will now not be met, up to £8.7m of central cost could fall away from costs next year. The elimination of all performance-based bonuses would add almost 20% to group EBIT and raise margins to 15.7% versus 12.5% all things remaining the same.

In my opinion, there is a broad opportunity for greater efficiency in YouGov’s investment, with the last several years having seen notable investment in new product initiatives with little success. From 2021, YouGov has attempted to launch several new platforms including YouGov, Direct, Safe, Chat and Finance. These initiatives have so far seen limited success with most being folded into YouGov’s behavioural suite of products.

In recent years YouGov’s investment spending has been inefficient, with initiatives often too varied and overly ambitious. This unproductive spending has largely been reflected in segmental EBIT margins, with all investment allocated to individual segments. I believe that given the continued growth and operational leverage from the company there has been little incentive for YouGov to address areas of unproductive spending. The significant profit warning in June has changed this dynamic. The company has already highlighted that it will undertake a cost rationalisation exercise in FY25. I would expect that if the company takes an aggressive approach to address its cost base, for example through zero-based budgeting, margins can be improved simply through greater efficiency.

Time to focus

The key point in Meta’s journey was the call from investors to get fit. Notable investors called for Meta to streamline, focus and curb its excess spending. The moderation in spending, and associated increase in operating margin expectations subsequently became a significant driver of Meta share price recovery. I think that the time is now right for YouGov to also get fit.

I’ve covered a number of the resources that YouGov has available to drive future performance:

Strong competitive advantages compared to other players

Increased company scale and offering through the CPS acquisition as well as numerous levers for the company to pull to drive margins.

Now, YouGov need to execute, much like Meta did, so they can recover successfully and continue to grow.